Solutions

ACP Limit Management

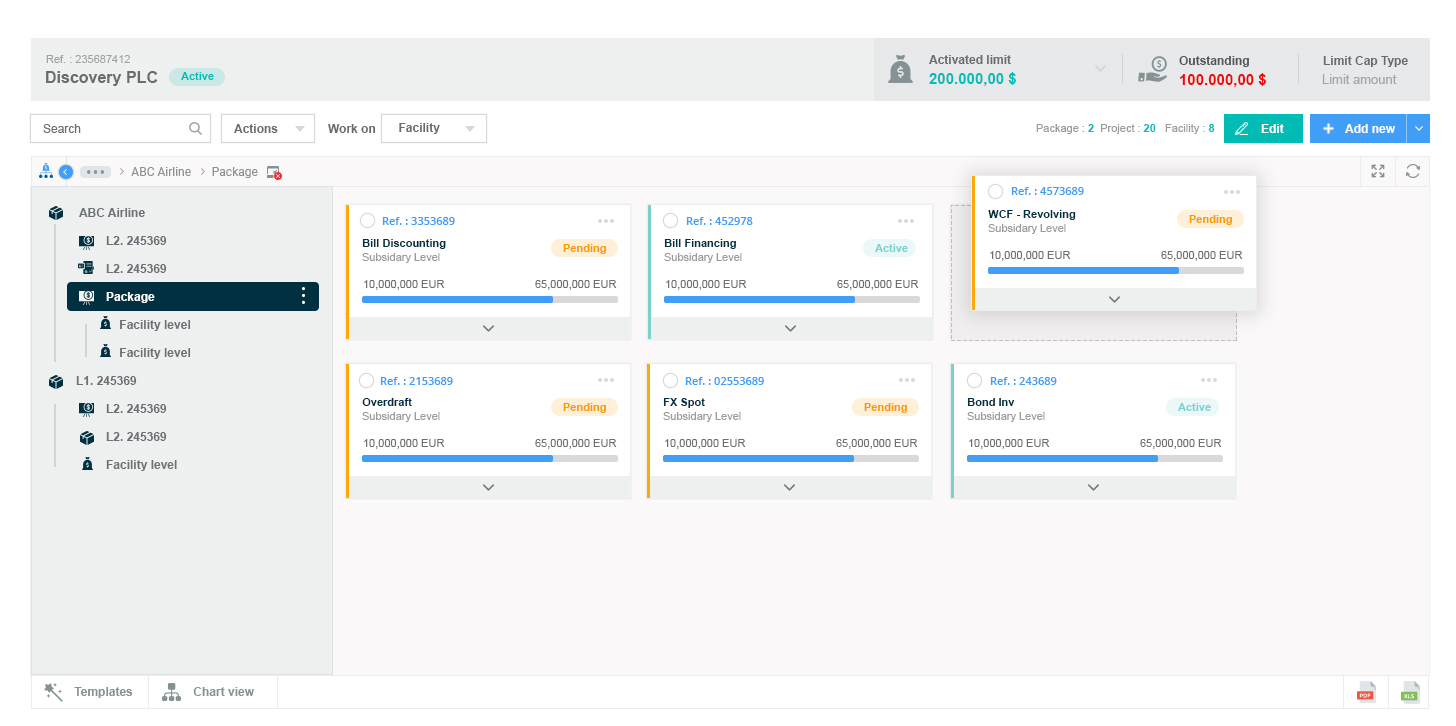

ACP Limit management offers a digital solution for proactive monitoring and centralized observation of credit limits across business segments, enhancing risk management and operational efficiency

1/ Limit request/Setting Limits

2/ Monitoring Limits

3/ Adjusting Limits

4/ Reviewing Limits

5/ Enforcing Limits

6/ Reporting and Analysis

Enhanced accuracy in credit risk and profitability across diverse business segments

Monitor your client limits to maximize your reward at a lower risk

- Monitor facility limits automatically

- Handle complex multi-level limit structures

- Capture the full limit terms and conditions

- Handle all types of limits including Settlement and Pre-Settlement limits

- Manage time-bucket limits for Derivatives

- Aggregate utilizations at any level of the limit structure

- Perform from real-time pre-deal check limit breaches

- Respond immediately to customer utilization requests

- Manage limit lifecycle events

- Generate statistics on utilization levels across the limit lifecycle

- Dynamic limits, LTV thresholds monitored in real-time

- Limit warning thresholds allowing an early risk awareness

- End-to-end data and information integrity and coherence from origination to limit monitoring

- Online access to the entire history of limits: initiation, events, renewals, and excesses

Aggregate credit risk exposures at portfolio level and monitor against limits

- Powerful real-time pre-deal checking

- Multi-dimensional portfolio aggregation strategies

- Historical portfolio snapshot storage, slice and dice credit data analyses, dashboards, and dynamic reports building.

- Advanced portfolio analysis features

- Flexibility of unlimited add-ons of aggregation strategies, new exposures, and consolidation path definitions.

- Pre-configured OLAP cubes, dashboarding environment, and MIS reporting.

- Automated and faster credit risk consolidation process across the bank portfolio

- Slice and dice views of the credit portfolio through multiple dimensions

- Multi-dimensional view of the portfolio consolidation strategies

- Enterprise-wide risk reporting of credit-related activities

- Portfolio limits across a combination of dimensions and monitoring of breaches, excesses, and exposures

- Ensured regulatory compliance on concentration limits

Axe Credit Portal is trusted by