PARTNER ACP (pACP), A REALM OF NEW REVENUE STREAMS UNLOCKED FOR RETAILERS & SERVICE PROVIDERS

Facing a restless agile market, retailers need innovative solutions addressing complex business logic. However, the lack of relevant financing options is one of the main causes of customer churn.

Customers are looking for retailers offering easy-to-use, fully digital, and affordable financing solutions to build a direct relationship with rather than a third-party lender.

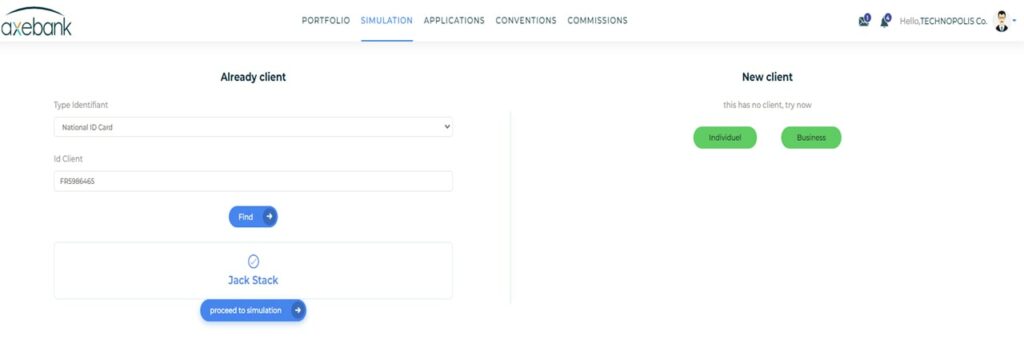

Partner ACP – pACP – is a user-friendly portal offering a seamless financing journey available in-store or across the retailer’s e-commerce channels (website or mobile app). Ensuring prompt loan disbursement through a simplified process at the Point of sale (POS), PACP alleviates the need for long bank processes assisting both the business and the customer.

pACP helps banks transform their partners into real digital credit enablers while unlocking new product channels & revenue streams.

PACP, A FUTURE-PROOF BNPL & POS FINANCING SOLUTION

- Automated financing at the POS (Point of Sale)

- AI-Powered lending digitalization

- Suitable for existing or new-to-bank customers

- Granular & limitless configuration options

- Multi-language/currency/industry/entity

- Low-code platform

- On-premises or cloud-based

EMPOWERING BUSINESSES WITH AN AI-BASED END-TO-END SOLUTION

FROM KYC TO DISBURSEMENT AND BEYOND

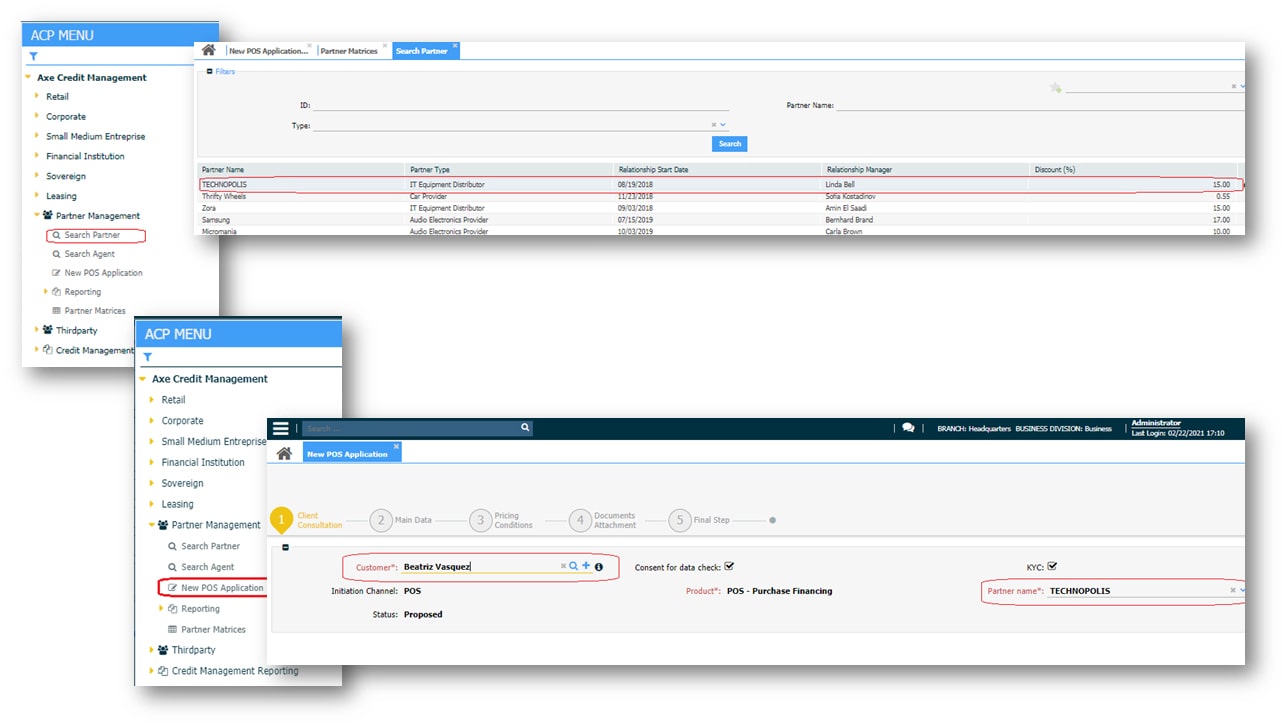

Traditional & AI-Based scoring integrated into one single platform for accurate credit decisions

Accurate creditworthiness and compliance checks are addressed through pACP powerful set of APIs ensuring a seamless integration of data from different sources.

- Customized pricing and approval workflows tailored to each and every partner’s industry vertical.

- Flawless risk mitigation thanks to pACP loan eligibility rules.

- Powerful APIs ensure data integration with external and internal databases while complying with GDPR international directives, country regulations, and bank policies.

Ensure a prompt loan initiation on the go

pACP powerful APIs allow an omnichannel initiation of the Credit Application (CA) leveraging AI to accelerate this first crucial step in a BNPL context:

- Customers can initiate the loan when browsing goods from partner online shops or mobile apps.

- Partners can initiate a loan on behalf of their customers either through a dedicated pACP workplace or by integrating their own Sales/CRM/KYC systems.

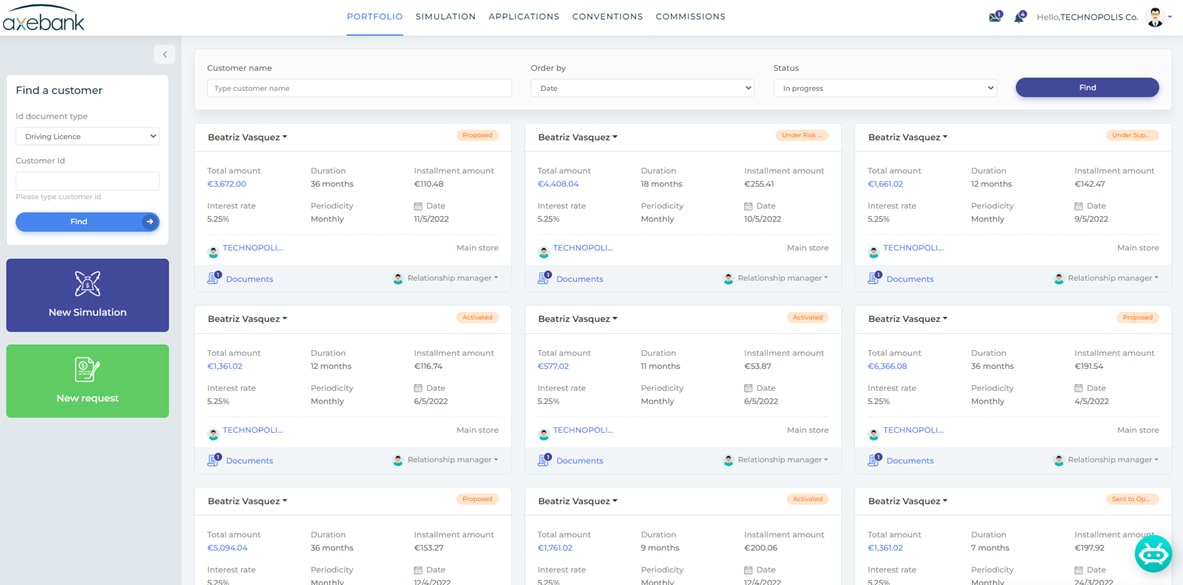

Advanced data analytics, useful for loan monitoring & beneficial for cross-selling opportunities:

- Banks and partners leverage pACP to offer an ultimate digital financing journey using mobile push notifications, to follow up on loan application status, as well as to convey loan rejection justifications.

- 360° dashboards of partner activity including pending CAs, disbursed loans, and rejected CAs.

- CAs’ data is stored in pACP to be leveraged for insightful reports, scoring, and cross-selling purposes.

Check out our documents

Resources