Efficiently Secure Your Assets and Comply with the Standards

axe Collection & Provisioning

axe Collection & Provisioning Solution enhances remedial strategies by providing additional efficiencies through streamlined processes and consistent data flows across the entire recovery process. A comprehensive, efficient and, cost effective solution that ensures an optimal return on investment in the short, medium and longer term.

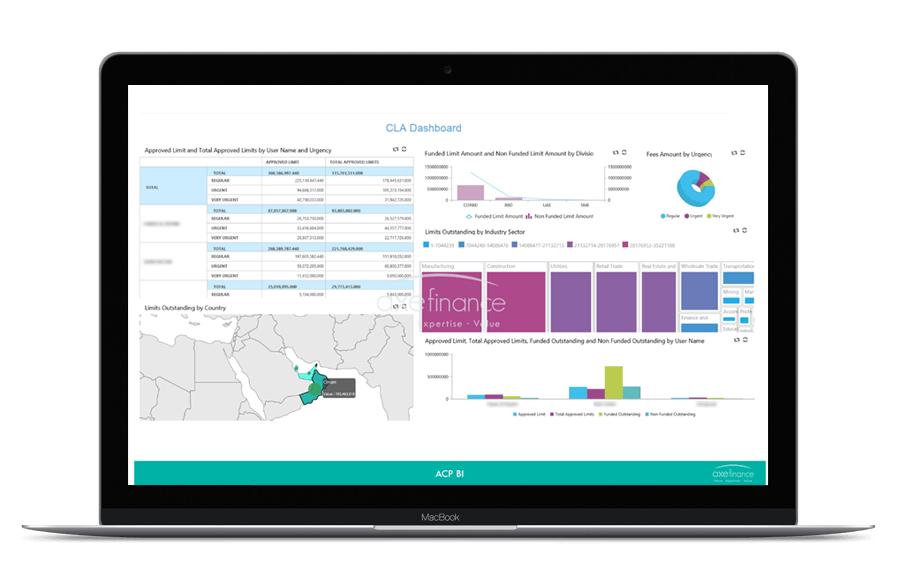

axe Collection & Provisioning Solution captures all the inputs required for calculating the expected losses and consequent individual or collective provisions for performing, doubtful and impaired assets.

Standard inputs into such calculations are stored within ACP such as “type of exposure”, “impairment status of the counterparty”, “number of days and amount of past due”, “credit events/types”, “probability of default (PD)” and “loss given default (LGD)”, “exposure interest rate”, “contracted cash flows”…

Provisions are calculated with multiple approaches including the internal bank process as per local regulation, group regulation as well as and IFRS9 approach.

Remedial workflows are triggered for doubtful and non-performing credits capturing all relevant details and circumstances, dates, etc. and their related recovery actions. The loss data collected can be later used to develop LGD and recovery related models.

Maximize your recovery rate while

improving your time to recovery

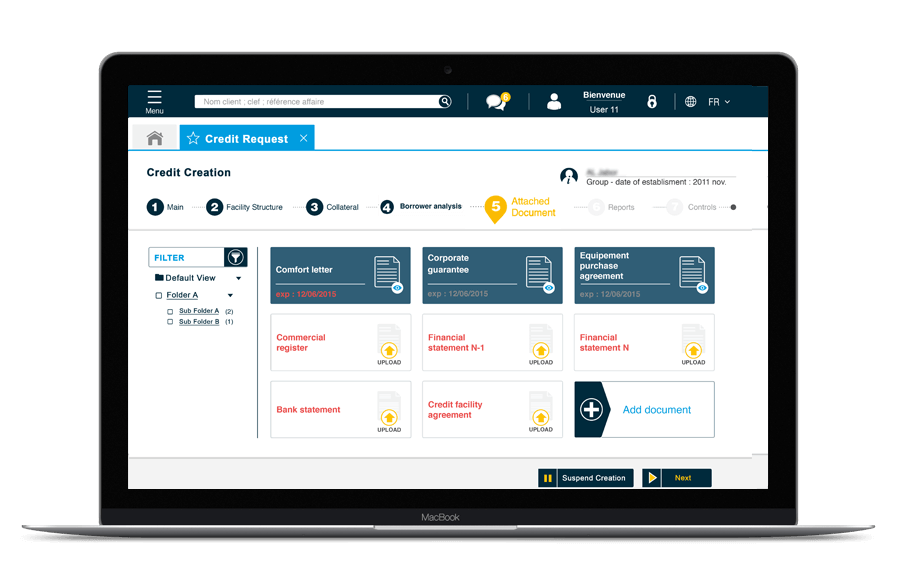

- Follow up and manage triggered credit event via dedicated and fully configurable workflows

- Customize various workflows according to “type of client”, “history”, “track-record”, “amount past due”, circumstances such as first recovery, second, “first notice”, “escalation level”, “amount to recover”, etc.

- Perform portfolio ageing and bucketing

Calculate your provisions as per internal,

Group and regulatory standards

- Identify and record changes in credit quality since origination

- Calculate general and specific provisions for performing, doubtful and impaired assets as per internal, group or IFRS9 rules

- Classify assets: stage 1, 2 and 3

- Integrate NPL data either manually within ACP or extracted from Core Banking or any other source system

- Host models and capture all inputs required for calculating ECL (Expected Credit Loss) and provisions: PD (12-month and Lifetime), LGD, Outstanding, CCF

- Closely monitor client credit worthiness trend and identify any increase in credit risk

- Benefit from your collateral portfolio quality when calculating your provisions

- Compare internal/group provisions vs. IFRS 9 calculations

Check out our documents

Resources