Solutions

ACP Collateral Management

1/ Collateral Identification

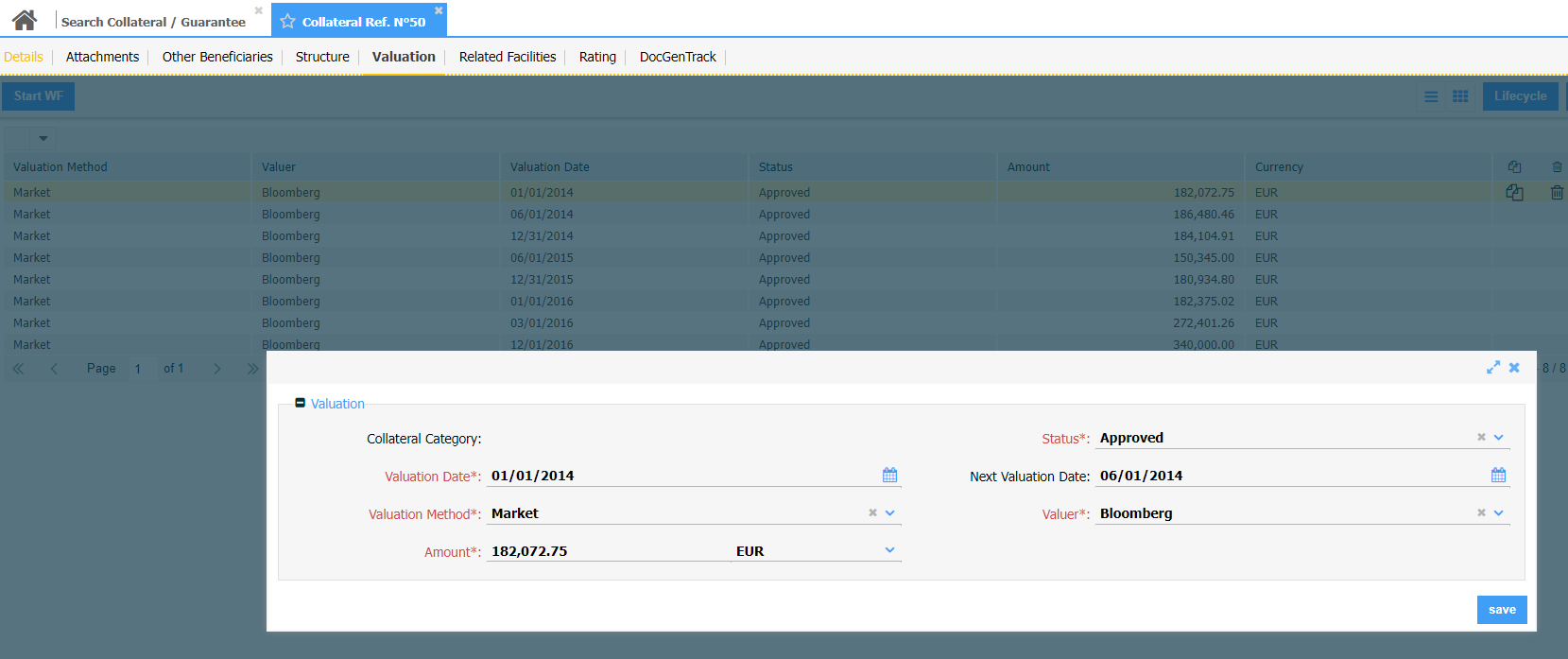

2/ Data Capture and Validation

3/ Collateral Valuation

4/ Monitoring and Maintenance:

5/ Reporting and Compliance

6/ Release or Liquidation

Comprehensive automation of your collateral management

Centralize your collateral repository and streamline their processes

- Granular collateral capture

- Flexible allocation and ranking

- Streamlined appraisal and monitoring

- Diverse collateral handling

- Historical valuation storage

- Collateral reuse and eligibility rules

- Financial collateral security

- Handling multiple valuation methods

Proactively manage your collateral portfolio

- Consistent collateral documentation.

- Monitor LTV and trends, and adjust margin as needed.

- Apply appropriate haircuts at the granular or category level.

- Monitor collateral concentration across the portfolio.

- React quickly to market movements.

- Monitor collateral portfolio liquidity.

- Monitoring reports and alerts/ticklers through various channels.

- Proactive monitoring and tracing of collateral waivers, releases, and deferrals.

- Automated Collateral portfolio revaluation tools.

- Dynamic calculation of collateral availability,

- Partial/total release workflows

- Insurance schedules, alerts, messaging, and remedial workflows.

Comply with rules and regulations

- Enforce standardized processes in collateral management.

- Complete documentation workflows.

- Maintain collateral checklists and eligibility rules.

- Apply regulatory haircuts.

- Generate your regulatory reporting.

- Consistent and quality collateral data for risk systems.

- Utilize historical data for EAD/LGD calibration.

- Ensure detailed audit trails.

- Regulatory collateral classification.

- Data model flexibility and evolution.

- Optimize capital calculations with improved collateral assignment.

- Document tracking and compliance with internal policies and regulations.

Axe Credit Portal is trusted by