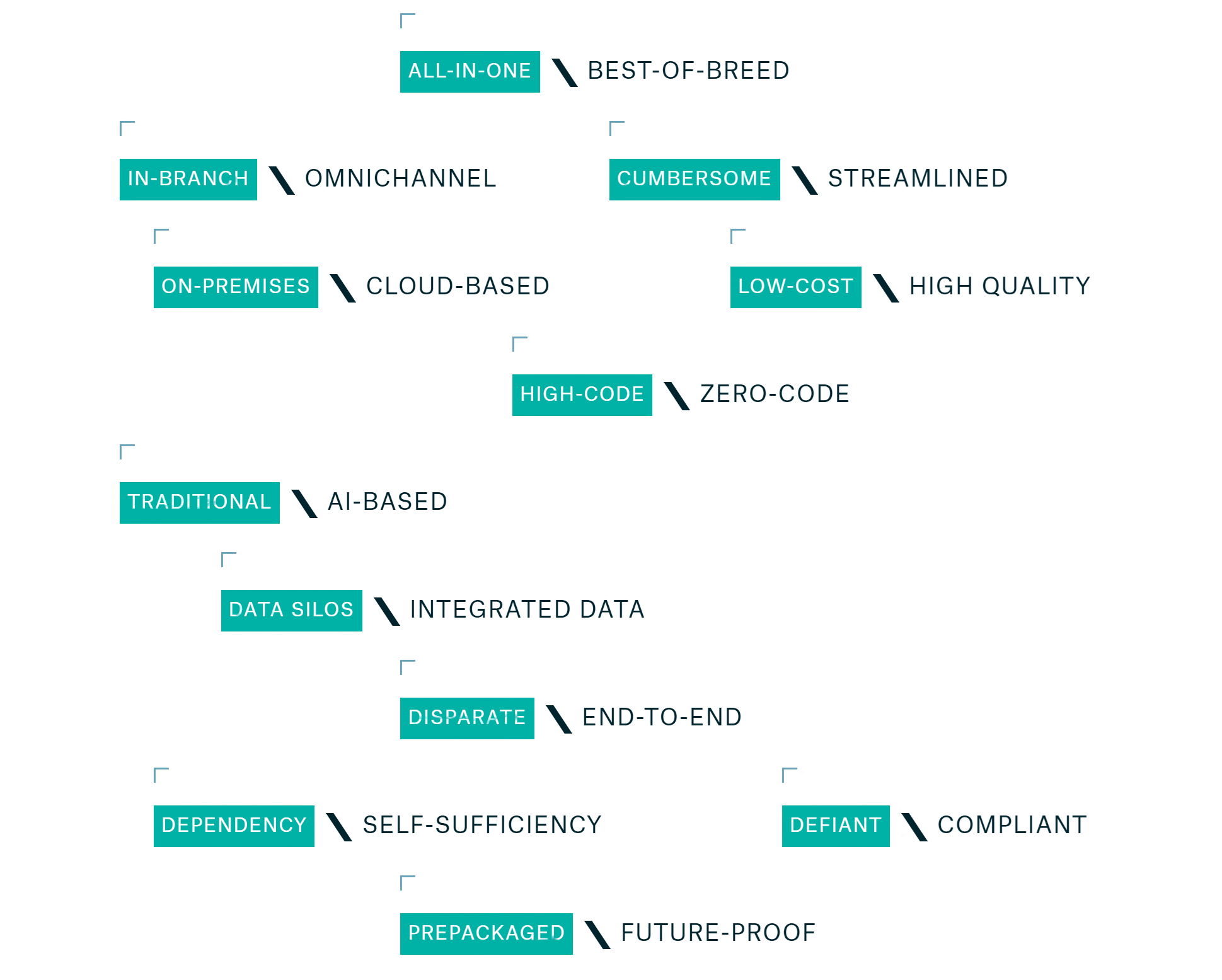

Why Axe Credit Portal ?

To unlock innovative financing journeys with holistic loan management software

To make the

To elevate yourthanks to a cutting-edge Digital Lending Solution

/ Consistency

/ Accuracy

/ Efficiency

/ Real-Time processing

/ Document & Data Integrity

/ Agility & Scalability

/ Digital inclusion

/ Self-sufficiency

/ Costs

/ Time to Market

/ Turnound Time

/ Credit Risks

/ Paperwork

/ Operational Risks

/ Manual Processing

/ Fraud

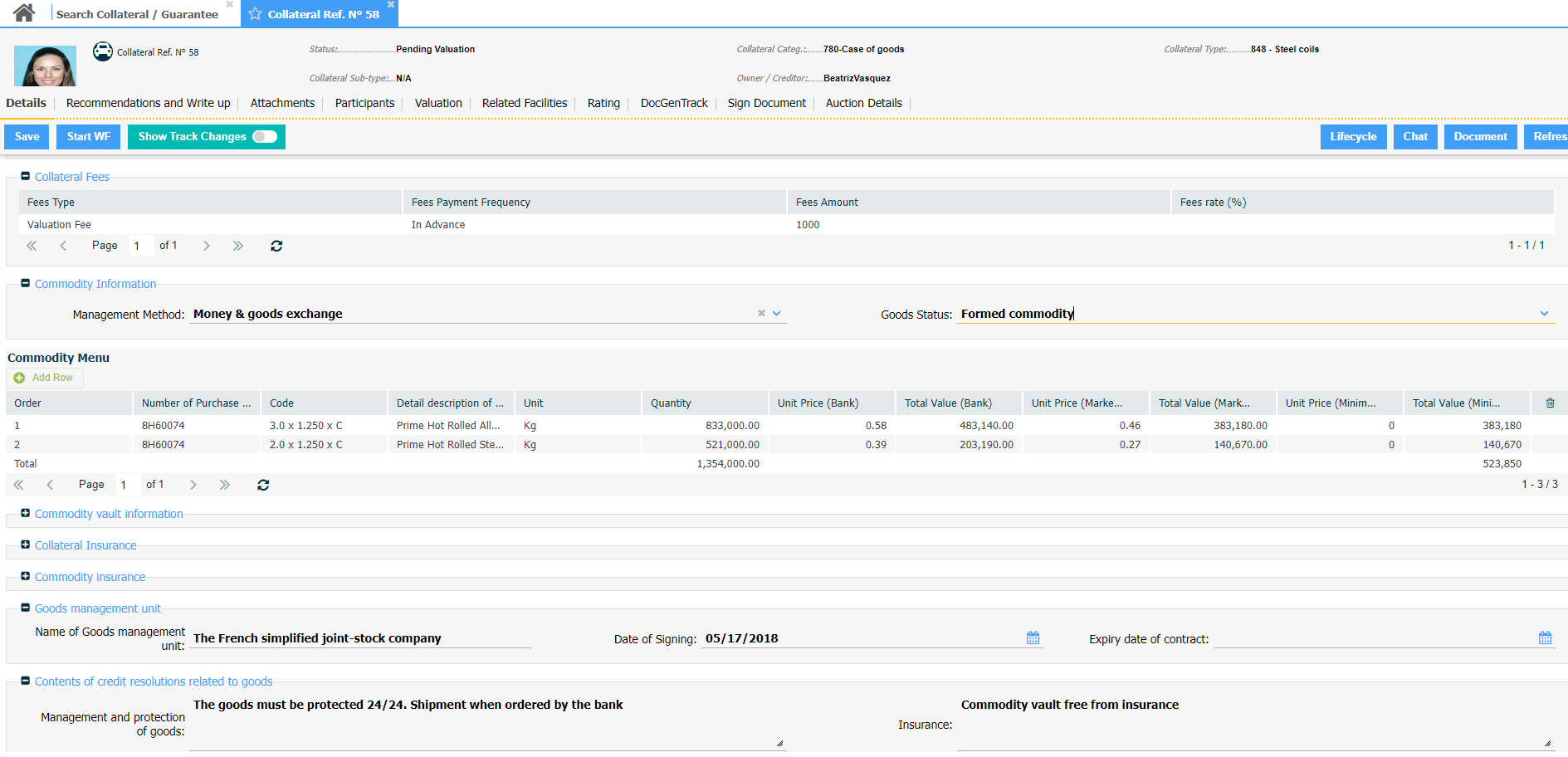

To Benefit from an of your credit process

Unlock streamlined efficiency and enhanced control with our comprehensive loan management software ACP. Automate every step of your credit process for unparalleled lending performance.

- AI-Powered digital lending

- Open lending architecture

- End-to-end unified loan management

- Omnichannel financing journey

- Multi-segment solution

- Granular & limitless customization

- User-friendly & zero-code platform

- Multi-language/currency/entity/industry

- Cloud-agnostic solution

To opt for a collaborative solution for all

Information System Architect

You’re responsible for the information system architecture within an internationally active bank which is organized along business lines according to client type such as industrial groups, energy and commodities and financial institutions. Often a company that is classified as a parent company in one category also acts as the guarantor for companies classified in another category.

Credit Committee Chair

Within a major international banking group with your Committee, you select credit files from among those presented by credit analysts after having been assessed by the Risk Department. Using reports from the various departments, the committee reviews and appraises each file in line with the bank’s lending capacity.

Micro Finance Manager

Within a Micro Finance Institution (MFI) in Africa and aware of the large volume of processed files, you want to automate as many tasks as possible, notably the extension of credit to a high number of small borrowers.

Risk Director

Managing complexity such as analyzing credit applications in different contexts, manage risk in abiding by the bank’s allocation rules…are your biggest challenges

Credit Analyst

To handle financing applications from international groups with intricate legal structures, including joint ventures, projects and local subsidiaries of international companies and to present these applications regularly to the Credit Committee [...]

Credit Officer

You’re responsible for the information system architecture within an internationally active bank which is organized along business lines according to client type such as industrial groups, energy and commodities and financial institutions. Often a company that is classified as a parent company in one category also acts as the guarantor for companies classified in another category.

To always be at the vanguard of the

Cloud-agnostic digital lending solution

- Select between on-premises software implementation or the streamlined efficiency of ACP Cloud Lending

- Benefit from a state-of-the-art credit automation solution accessible via the cloud

- Enjoy convenience and flexibility with cloud-based deployment

- Industries served by our Cloud lending platform: Banks, Microfinance, Lease Finance, SME Lenders, Community Banks, and Consumer Lenders

AI-powered credit automation

- Empower your bank with cutting-edge AI-driven lending revolutionizing credit risk management.

- Benefit from enhanced customer profiling, early risk detection, efficient credit scoring, and seamless content extraction.

- Move from reactive to proactive credit decision-making and portfolio monitoring for optimized lending outcomes

Omnichannel financing journey

- Seamlessly integrate lenders, customers, and all credit stakeholders onto a unified open lending platform.

- Enable flawless orchestration of interactions across multiple channels and devices.

- Ensure a cohesive and efficient lending experience for all parties involved.

- Streamline real-time communication for optimized lending processes.

Compelling APIs & Open Lending Architecture

- Easy integration with various systems and applications, enabling financial institutions to adapt to changing market demands and regulatory requirements more effectively.

- Scale your lending operations more efficiently to accommodate business growth and increasing transaction volumes.

- Foster innovation leveraging third-party solutions, APIs, and emerging technologies more readily,

Agility via ACP STUDIO

ACP Studio offers a game-changing set of built-in zero-code configuration tools, providing limitless customization options:

- ACP Business Rules Management (BRM)

- ACP Business Process Management (BPM)

- ACP Graphic User Interface (GUI) Designer

- ACP Document Management System (DMS)

- ACP Identity and Access Management (IAM)

- ACP Machine Learning Pipeline (MLP)

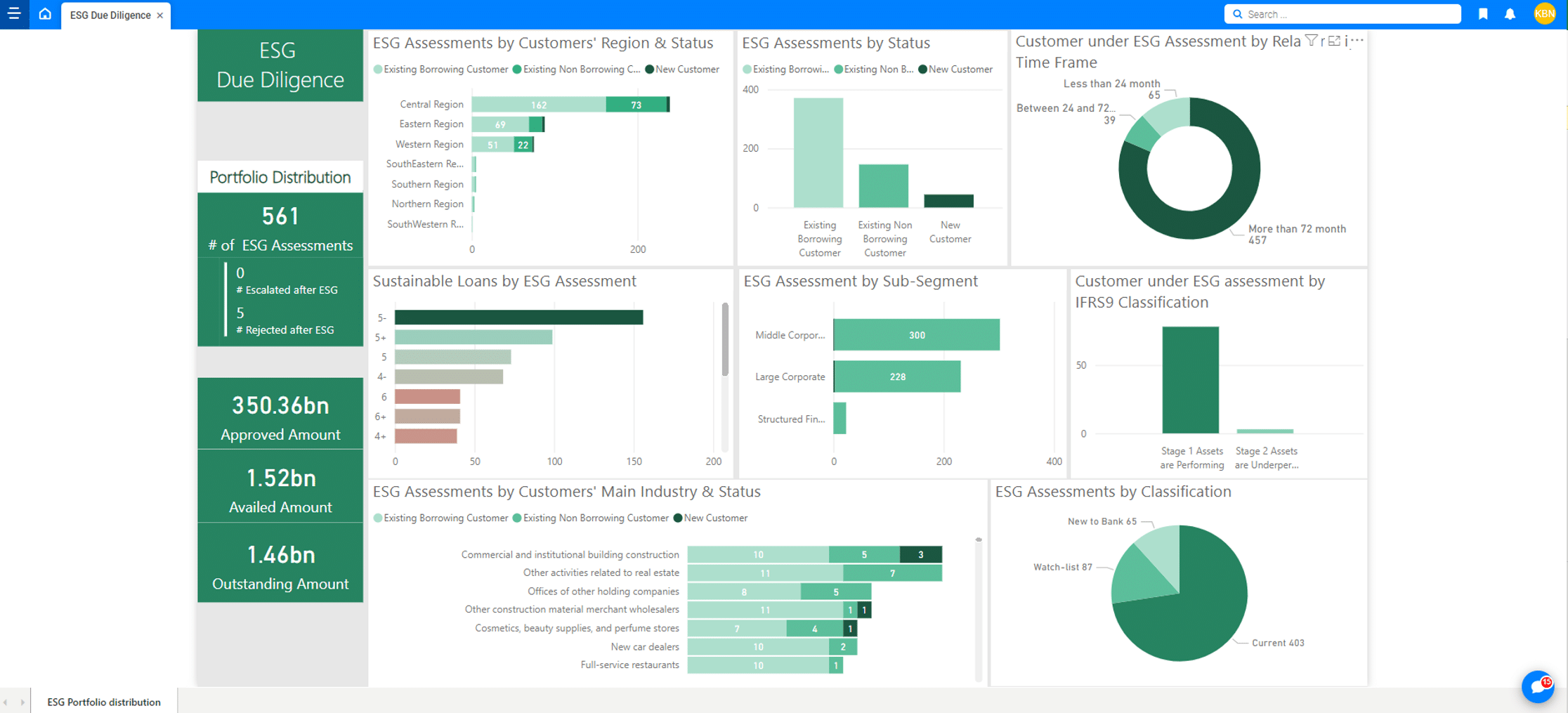

A single database for a unified end-to-end credit automation

Utilizing a single database, ACP serves as the centralized platform for comprehensive loan performance monitoring, offering the following benefits:

- Seamless Integration: ACP ensures seamless integration across various segments, credit lifecycle stages, and functionalities, facilitating smoother credit workflow automation and enhancing overall efficiency.

- Data Consistency: with a single database, ACP maintains data consistency across different processes, reducing the risk of errors and discrepancies associated with using multiple databases.

- Real-time Insights: ACP provides users with immediate access to real-time performance metrics and key indicators, enabling informed decision-making and proactive management.

- Simplified maintenance: managing a single database is more straightforward and cost-effective compared to multiple databases, resulting in lower overhead and maintenance costs for lenders.