In 2025, banks across the UK and Europe confront a dual challenge: rapidly evolving regulations and legacy infrastructures ill-suited to keep pace. From the FCA’s Consumer Duty to the EBA’s ESG risk guidelines and the ECB’s climate stress tests, financial institutions must reconcile swift credit decisioning with exacting transparency requirements, yet many still rely on fragmented systems and manual processes.

Free up budget by cutting compliance spend

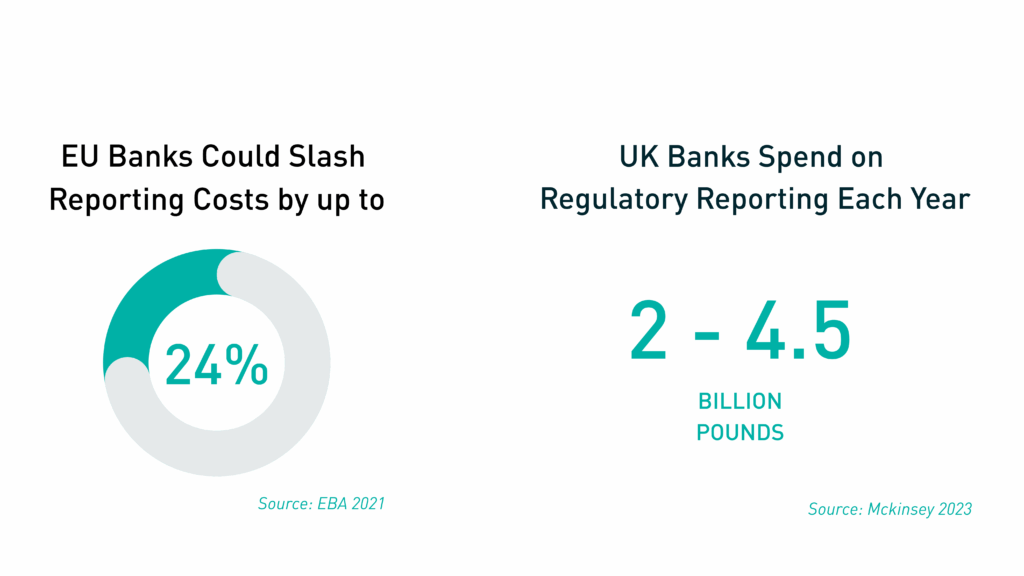

Regulatory reporting has become a multibillion-pound challenge in itself. McKinsey estimates that UK banks spend between £2 billion and £4.5 billion annually compiling, validating, and submitting reports to the FCA and Bank of England, a burden equivalent to up to 2.2% of operating costs, according to the Bank for International Settlements. In Europe, the EBA has calculated that simply harmonizing and streamlining templates could cut these costs by 15–24%. And across the Atlantic, U.S. regulators still grapple with duplicate data submissions, further underscoring the need for a single, machine-readable rulebook.

This heavy reporting toll sets the stage for the next challenge: ensuring that every customer interaction, from product disclosures to risk explanations, meets heightened clarity and timeliness standards.

Achieve rapid, transparent customer engagement

Since July 2023, the FCA’s Consumer Duty has compelled firms to “communicate and engage with their customers so that they can make effective, timely and properly informed decisions. Firms must not only deliver fair outcomes but also generate plain-English explanations and well-timed notifications whenever terms change or products are withdrawn. In doing so, they must thread the needle between regulatory rigor and customer expectations—a task that often flounders on manual workflows and siloed systems.

The same imperative for transparency now extends into environmental, social, and governance criteria.

Transform ESG Data into Actionable Intelligence

European banks today face an unprecedented volume of ESG-related requirements—from CSRD disclosures and EU Taxonomy alignment to EBA guidelines and Pillar 3 expectations. Yet many institutions still struggle to operationalize these frameworks due to fragmented data systems and manual workarounds. Without a centralized, automated approach, ESG data collection often becomes a patchwork of spreadsheets and siloed tools, slowing down workflows, weakening data reliability, and increasing audit risk. The result? Institutions fall behind on reporting, delay sustainable lending initiatives, and miss the opportunity to build trust with both regulators and stakeholders. To move from reactive reporting to real ESG impact, banks need intelligent automation that embeds sustainability metrics directly into credit workflows, turning compliance from a burden into a strategic advantage.

Accelerate Compliance by Ending Spreadsheet Reliance

A KPMG survey found that 47 % of companies continue to track ESG metrics in spreadsheets, risking “inaccurate and incomplete” reporting. A Wolters Kluwer study further showed that 42 % of institutions still rely on manual compliance steps, eroding both speed and transparency.

Just as data silos hinder ESG, opaque AI models challenge credit governance.

Explainability: from black boxes to transparent models

Banks are increasingly adopting AI/ML for credit scoring, fraud detection, and risk monitoring—yet the BIS cautions that “lack of explainability makes it challenging to assess the appropriateness of AI models,” and global guidelines insist on “transparency, fairness, [and] accountability” (bis.org). Under the EU’s AI Act, credit-scoring algorithms are classified as high-risk and subject to impact assessments and user explanations. The FCA’s Consumer Duty also demands that customers receive the information needed for “effective, timely and properly informed decisions” (fca.org.uk). An EBA survey echoes this tension: institutions often “boost accuracy at the cost of lower explainability,” underscoring the need for methods like SHAP (SHapley Additive exPlanations) that deliver both performance and interpretability

Faced with these intertwined reporting, data, and model-governance demands, many banks are turning to technology to break the bottleneck.

Axe Finance’s blueprint for regulatory agility

Leading institutions are bridging the gap between complex mandates and day-to-day operations by instilling three core capabilities:

- Explainable decisioning: automated, traceable rationale generation that satisfies both FCA Consumer Duty and EBA transparency requirements, ensuring every credit decision is traceable and defensible.

- Embedded ESG intelligence: sustainability and affordability scoring are woven directly into origination workflows, eliminating manual handoffs, and supporting real-time reporting under CSRD and Taxonomy rules.

- Containerized, cloud-native deployment: a modular, microservices architecture, deployable on any public or private cloud, allows rapid policy updates, version control, and consistent performance across regions. By unifying data, analytics, and regulatory logic in a modular architecture, banks can slash reporting cycle times, reduce manual error rates, and demonstrate real-time governance readiness.

Thanks to Axe Finance’s ACP compliance layer, a leading EU bank actually reduced its regulatory reporting preparation time by 40%.

Experience it live

These regulatory capabilities are especially vital in fast-growing segments like SME lending, BNPL, and embedded finance, where traditional models fall short. In the UK and EU, lenders in these spaces must now meet the same standards of credit transparency, affordability assessment, and outcome fairness as larger institutions. Whether supporting under-documented SMEs or enabling point-of-sale financing, banks need explainable AI, modular compliance workflows, and real-time policy enforcement. Axe Finance’s multi-segment, cloud-agnostic platform ensures that banks can scale responsibly across these models without compromising on compliance or customer trust.

Join us this June in London, at the Lending Transformation Summit to see these principles in action. Witness a consumer duty-compliant underwriting simulation with automatic audit-trail generation; explore an ESG-linked origination workflow that dynamically adjusts terms based on live sustainability metrics; and learn how Axe Credit Portal software is helping early adopters tackle these challenges and many others in the lending landscape.

📍 Book your private demo at booth E#20

Discover how Axe Finance’s cloud-agnostic, end-to-end solution transforms compliance into a competitive edge. Our multi-segment platform auto-generates Consumer Duty-compliant decisions in real time, streamlines ESG-linked credit, and slashes reporting costs all within a unified, modular architecture.

Spots are limited. Pre-book your session now to secure priority access.