ACP AI-powered Lending

Unlocking the ultimate banking potential with ACP AI-powered Lending

ACP Innovative digital lending with over AI applications across the credit lifecycle

Experience disruptive lending innovation with ACP's AI-powered capabilities

Deliver innovative banking excellence and elevate customer satisfaction through ACP AI-powered lending

- AI-powered borrower onboarding and Credit Application

- Automated onboarding and follow-up processes

- Automated monitoring of client limits and efficient risk mitigation

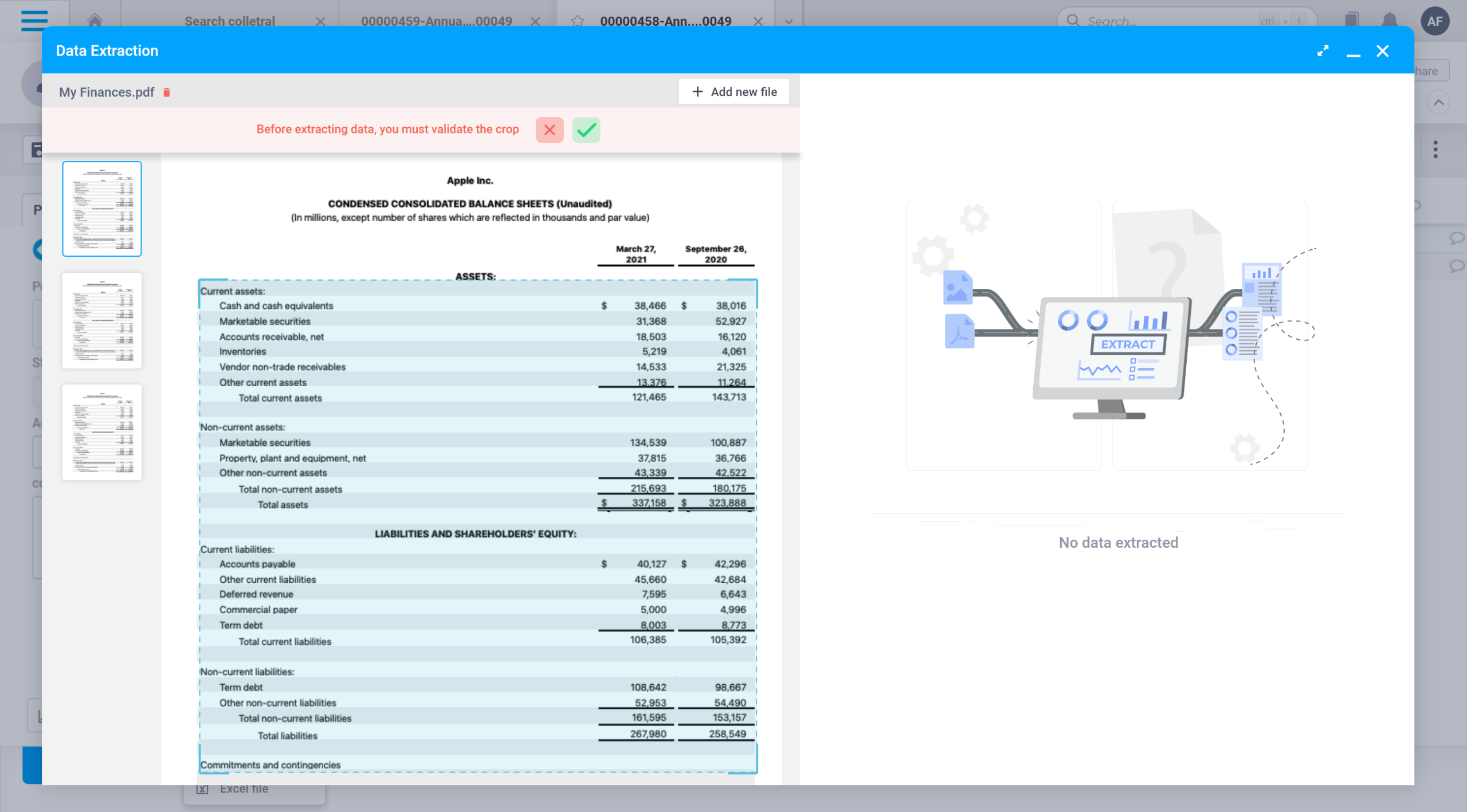

- Automatic Content Extraction (OCE)

- Employ advanced automation systems to identify potential leads, leveraging targeted marketing campaigns, website interactions, and referrals.

- Pushing customized credit offerings, encouraging cross-selling opportunities.

- Documents and Financial data automatic extraction

- Real-time data integration with external and internal data sources

- Enhanced credit decision quality through integrated new data sources (Adverse media, Sentiment Analysis)

- Innovative ML-based scoring models

-

Build and customize robust and performing Machine Learning pipelines.

-

Produce and deploy high-performing AI-Powered Early Warning Signals models.

-

Monitor internal & external data quality.

-

Ensure a high level of accuracy thanks to powerful AI-based algorithms.

-

Automate knowledge extraction and analysis through state-of-the-art techniques such as Natural Language Processing (NLP), Predictive Analytics, Big Data Mining, and Clustering.

-

Benefit from new analytical perspectives based on customer performance and interactions.

-

Improve delinquency prediction accuracy through changes in customer behavior patterns (tracked, reported, and assigned appropriate severities)