Solutions

ACP CORPORATE LOANS

ACP Corporate Loans software covers a wide range of loan types

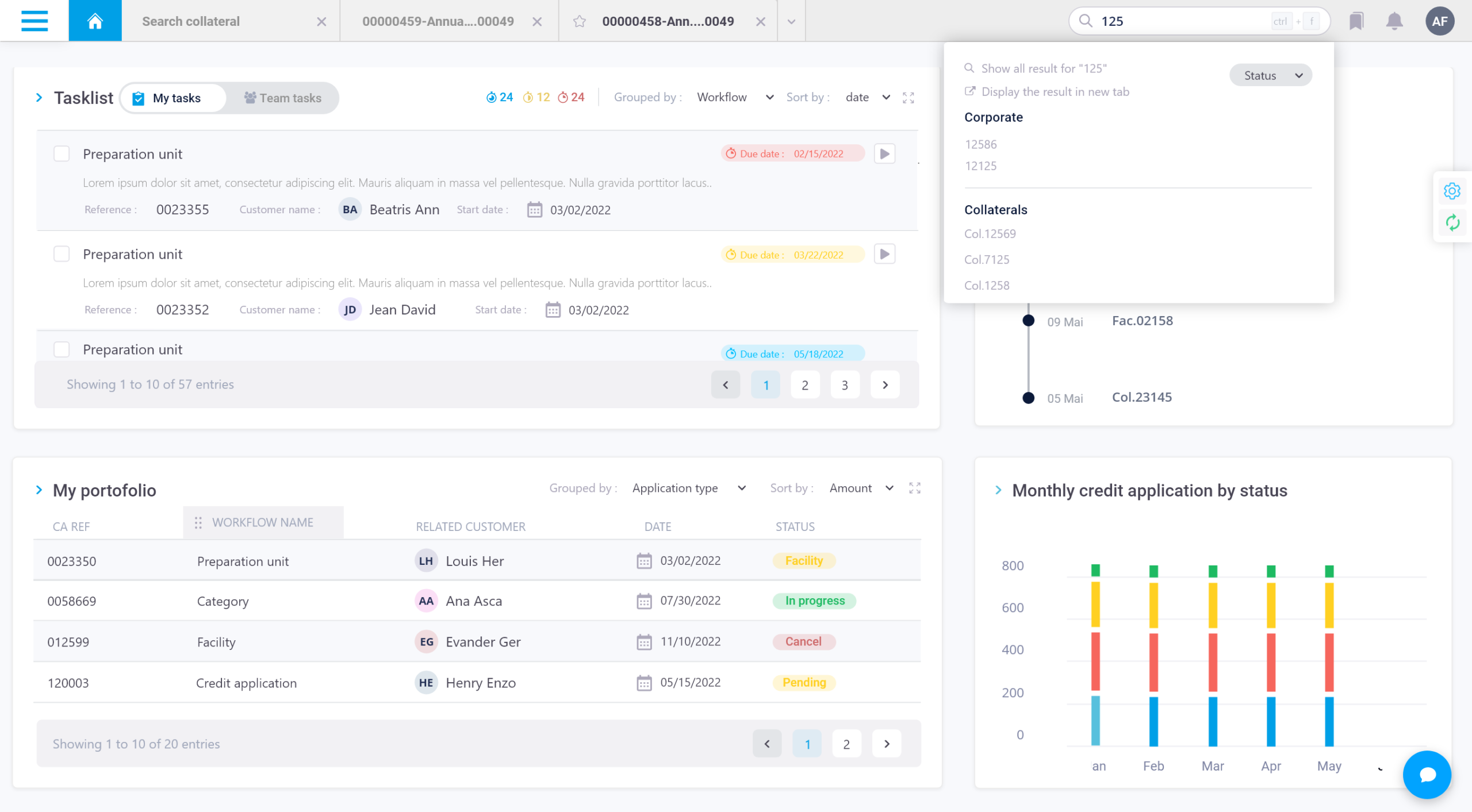

Empowering lenders with a comprehensive Corporate Loan Origination software

Ensure a digital onboarding and prompt credit initiation

- Customizable leads and KYC

- AI-powered borrower onboarding (face/ID recognition)

- AI-powered Credit Application (CA)

- KYC & PEP checklists

- Industry, market, competitors, vendors, suppliers’ details capture

- Financial reports, cash flow, and peer analysis

- A complete °360 integrated and single view of the customer

- Multi-entity group credit application

Traditional & AI-based scoring integrated into one single platform

- Real-time data integration with external and internal data sources

- Enhanced credit decision quality through integrated new data sources

- Innovative ML-based scoring models

- Customizable scoring template based on qualitative and quantitative scores

- Internal rating scale or customized scoring model via integration

- Ensured compliance with GDPR international directives, country regulations, and bank policies

- Automated delegation of authority as per the institution’s credit policy

- Risk-based pricing projections and actual calculations

- Tracking & monitoring: collaterals, covenants, conditions, and internal risk triggers

- Analysis of cash flows, peer comparison, credit analysis write-up

Data analytics for loan monitoring, servicing, and cross-selling

- °360 dashboards of partner activities

- CAs’ data storage for insightful reports, scoring, and cross-selling purposes

- Advanced portfolio analysis features

- Powerful business intelligence modules

- Historical data storage

- Slice and dice credit data analysis

- Dashboards and dynamic reports building

- Push notifications

ACP Corporate Loans is trusted by