Scale an innovative lending business model through technology

[The wave of digitalization in financial services in general and in the lending space in particular is accelerating. What started in the automation of the retail lending processes, with its high volumes and highly standardized processes is spreading to the more complex SME and corporate lending environment. Innovative actors are setting the tone and incumbents are seeking new ways to remain competitive.]

In our introductory article we defined “digital transformation” and shared our views on the lending digitization playing field. Now it’s time to zoom in on the digitalization strategies that we see in the lending market and share an example of the benefits our clients are seeing during their lending digitalization journey with Axe Credit Portal.

What digitalization strategies do we see in the lending market?

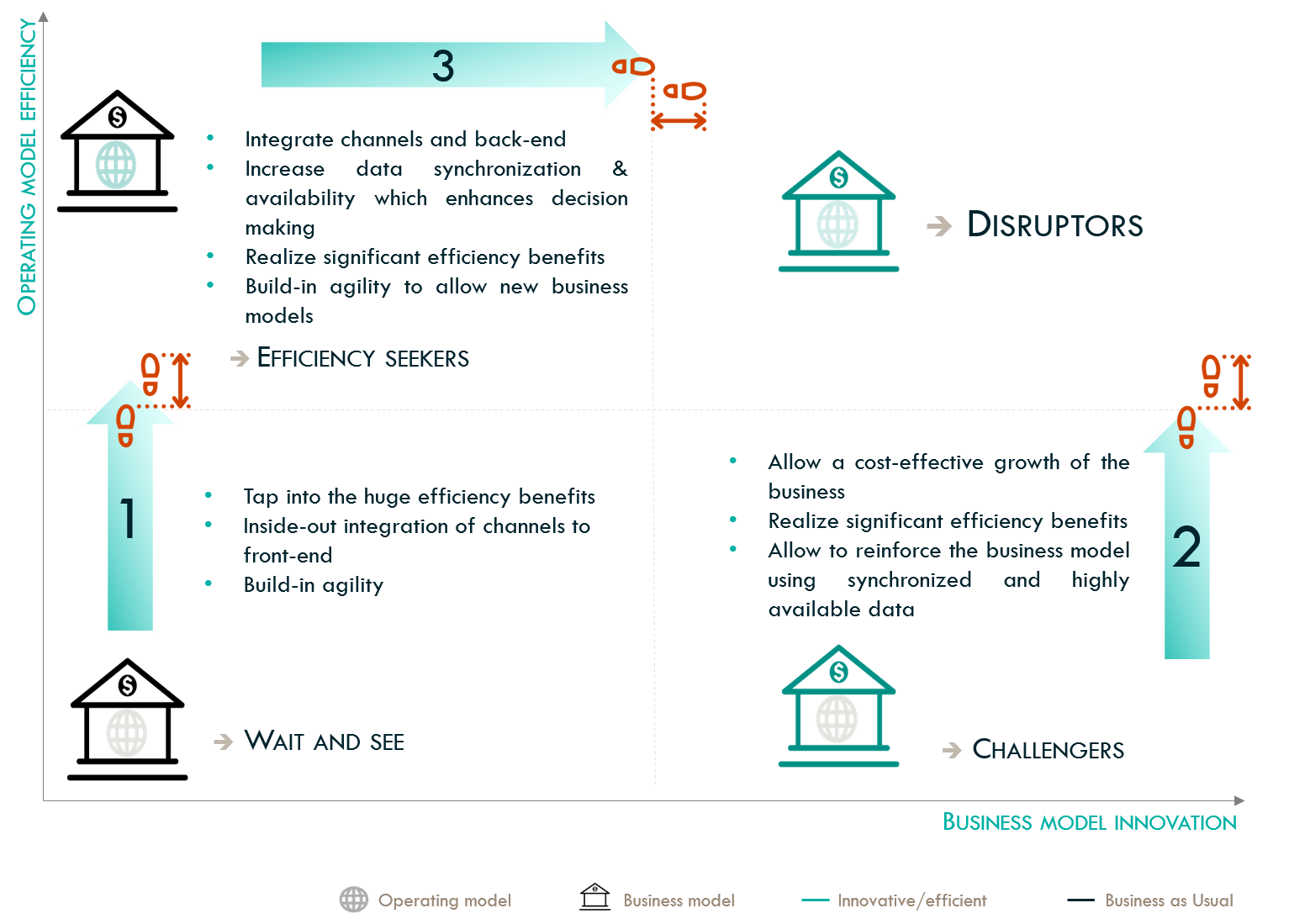

Starting from the lending digitalization framework we have developed, we have identified three main digitalization strategies (these strategies are not mutually exclusive):

- Unlocking efficiency

- Scaling through technology

- Triggering business innovation

In the next section, we provide an example of how axefinance helps innovative players in the lending market scale their businesses through technology (strategy 2 above).

SCALE INNOVATIVE LENDING BUSINESS MODELS THROUGH TECHNOLOGY

The lending landscape has witnessed the emergence of an alternative finance sector, which is taking innovative approaches to the lending business model, driven by technology and pressure to be more inclusive. Instead of competing with incumbent players in traditional retail or corporate segments, the alternative finance segment expands markets by creating new segments among underserved categories of clients through a combination of better risk mitigation and an operating model that drastically reduces acquisition costs.

Micro lending, crowd lending, non-secured SME lending from non-banks are examples of such innovations that have extended the breadth of the lending market. Entrepreneurs and businesses organizing themselves into credit unions to coach and fund their peers is another example of alternative lending. The push for alternative finance led Dutch alternative finance for SMEs players to set up an association to work on better structuring the sector and helping it gain more momentum. They have started with a Code of Conduct, which enters into force July 2019. The code can be found here (Dutch Only).

axefinance helps financial institutions around the world successfully execute innovative lending business model strategies. Our customer Développement International Des Jardins (DID) has designed and begun implementing its alternative SME lending model across multiple regions. DID is showing impressive results, and it’s just the beginning. Here is a snapshot of DID’s achievements so far:

- Harmonized lending processes

- Centralized oversight of the whole credit portfolio of all partners

- Flexible process mining based on continuous improvement of the lending process

- Enhanced credit risk assessment allowing DID to scale while remaining within its credit risk limits

- Drastically reduced acquisition costs and improved margins, allowing better pricing and wider reach

- Vastly increased number of credits initiated over the last two years 94% with only 43% growth of the credit team in the same period

- 200% increase in the number of branches over the last three years

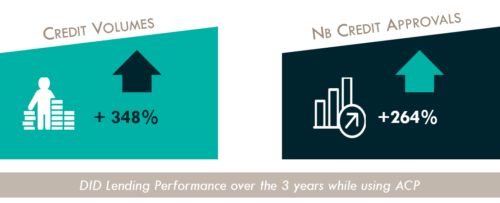

- Increase in the number of credits approved by 264% over three years thanks to an improved workflow

- Increase in the amount of approved credits by 348% over three years

The DID story is still in progress and the next chapters are promising (expansion and economies of scale). The partnership with axefinance and the implementation with ACP are key enablers for DID, allowing it to focus on its lending model strategy design. The flexibility and agility of ACP also frees DID to focus on future growth knowing axefinance will remain a cutting-edge partner in lending solutions.

For more background on our partnership with DID, we refer to the DID use case HERE

In our next blog, we will showcase strategy#2 in the framework above by providing examples of incumbents using innovative lending business models to gain an edge on the market. We will also present concrete examples of how axefinance technology enables its clients to quickly adapt to new client expectations with innovation and speed.

axefinance has helped many financial institutions around the world see significant cost savings and operational efficiency improvements without having to wipe out all their legacy systems. Moreover, with ACP, our clients have been able free up resources to increase their production, activate new channels and offer enhanced customer experience. If you would like to know more about how ACP could help you implement your own lending digitalization strategy, please reach out to one of our experts here.

Related Links

Leave A Comment