A SEAMLESS LENDING AUTOMATION EXPERIENCE ON THE GO

axeOMNICHANNEL

ACP lending automation solution offers an omnichannel customer centric module that puts the bank, the customers & all stakeholders on the same flexible & scalable lending digitalization platform.

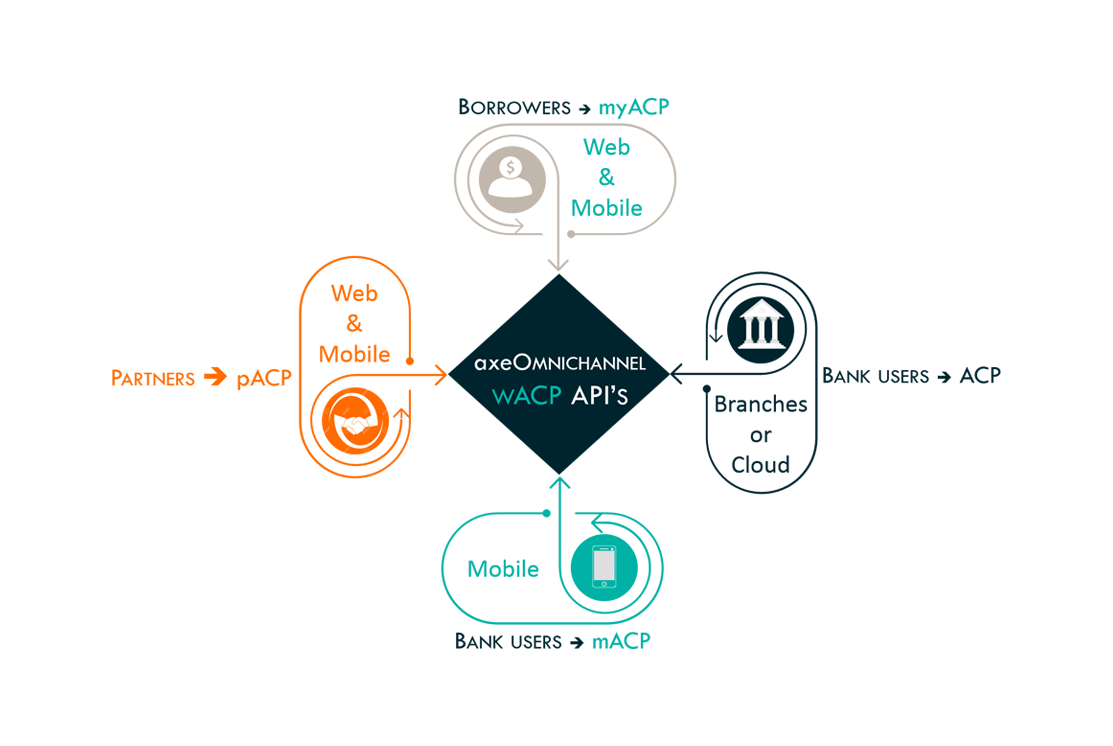

axeOmnichannel Banking Solution is the combination of ACP Business Services designed around the four building blocks wACP, MyACP, mACP & pACP. This module offers flexibility and highly configurable features through the lending digitalization journey for each and every bank segment (Retail, Commercial, SME, Corporate, etc.)

Omni Channel Platform : Modern architecture with limitless configuration options

- wACP: is the centerpiece of axeOmnichannel including a set of ACP components that offers rich digital business capabilities. These functions may be combined to create complex credit products and packages offered by banks to their customers & partners. These building blocks could be assembled by the bank and used through various channels.

- myACP: is the customer portal access (mobile & web) to credit products offered by the bank. The bank may opt for myACP’s front-end or chooses to consume its exposed services through its own internet & mobile banking existing portals.

- mACP: is the mobile application dedicated to bank staff who use ACP’s main functions through their mobile device. mACP is mainly used by relationship managers or approvers.

- pACP: is a front-end access (mobile & web) offered by the bank to its partners and credit products distributors. The bank may opt for pACP’s front-end or chooses to consume the exposed services through its own portal.

Mitigated risk & consistent credit processes through multiple devices, channels & stakeholders

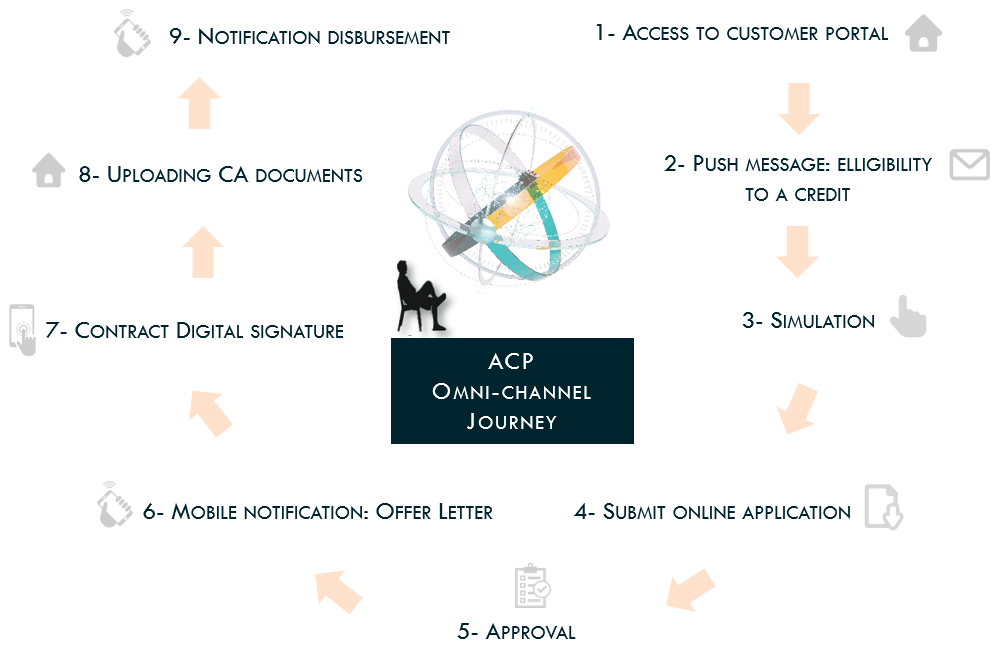

The credit application process spans over multiple complex stages. axeOmnichannel allows all of the credit lifecycle stakeholders to perform their duties through various channels. A credit application can be:

- Launched by a partner through pACP

- Assessed by the bank relationship manager through ACP

- Approved by the decision-maker through mACP

- Contractually signed by the customer through myACP

- Automatically sent to the Core Banking System for disbursement, etc.

Check out our documents

Resources