Solutions

ACP BI & Reporting

ACP's Business Intelligence (BI) and Reporting solution addresses these challenges with robust data analytics, intuitive visualization tools, real-time insights, and scalable architecture, empowering bankers to make informed credit decisions, optimize loan portfolios, and elevate the customer experience.

Decision Support

Deeper customer understanding

Operational Efficiency

Risk Management

Lending Performance Monitoring

Regulatory Compliance

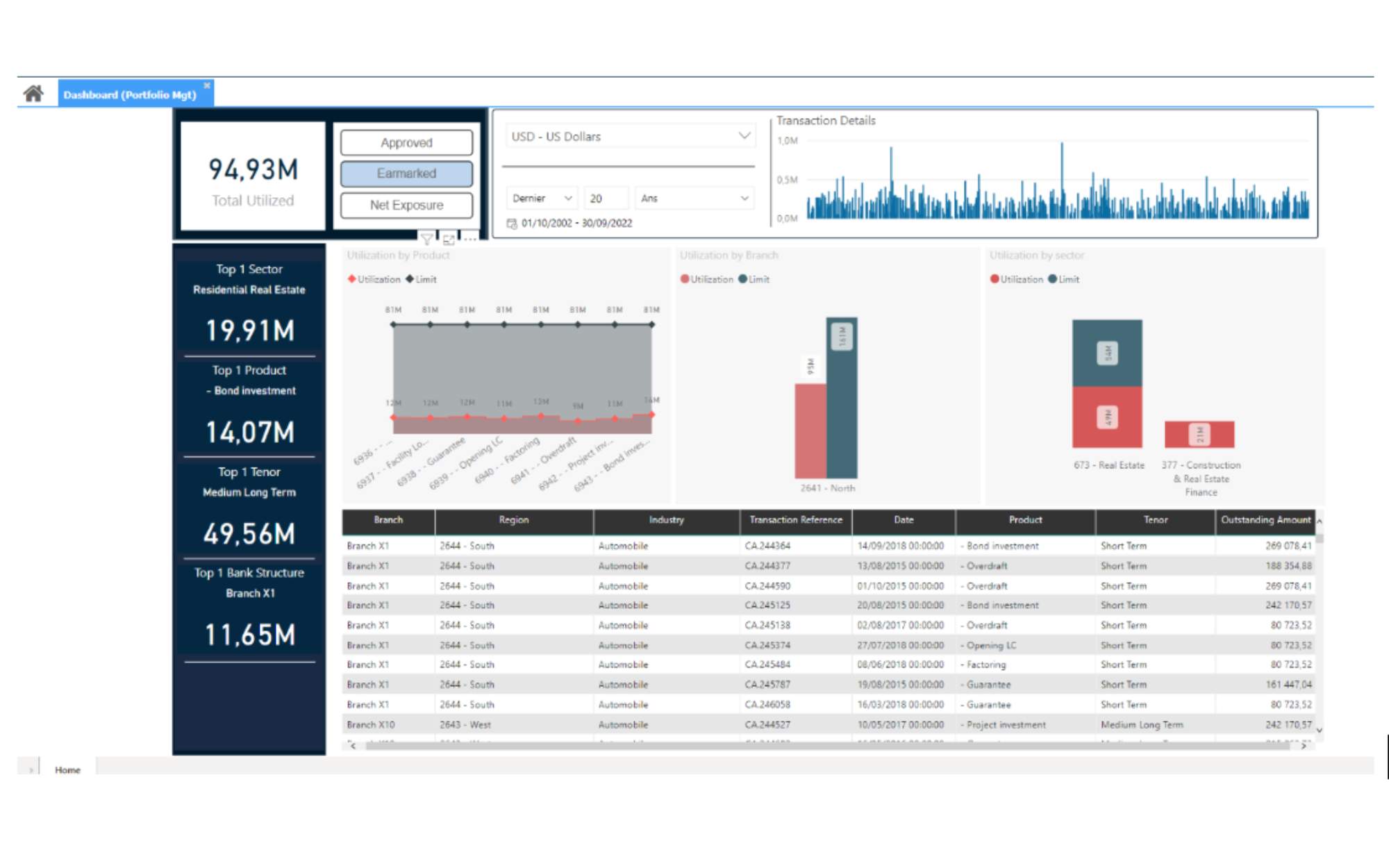

Empowering credit decisions and mitigating risks with precise and accurate KPI reportings

Intuitive and customizable dashboards, reports, and visualizations

- Advanced portfolio analysis features and powerful business intelligence modules.

- Real-time data integration with external and internal data sources.

- Move from intermittent and limited scope checking to regular and wide-range portfolio monitoring.

- Holistic screening and categorization of the credit portfolio.

- °360 dashboards of client activities and dynamic reports building.

- Compare real observations vs AI-based decisions thanks to advanced dashboards and charts provided to monitor the models.

- Compelling dashboards reflecting portfolio health, warnings history, as well as delinquency forecast with most risky exposures, while allowing to trigger action plan workflows.

- Dashboards and dynamic reports building.

- High level of data coherence and integrity.

Leveraging innovation to tailored lending products and services based on customer behavior

- Changes in customer behavior patterns are carefully tracked, reported, and assigned appropriate severities to improve delinquency prediction accuracy.

- Extension of credit to deserving applicants who would have been denied a loan using previous methods.

- Automate knowledge extraction and analysis through state-of-the-art techniques such as Natural Language Processing (NLP), Predictive Analytics, Big Data Mining, and Clustering.

- New analytical perspectives based on customer performance and interactions are available.

Axe Credit Portal is trusted by