Solutions

ACP Collection & Provisioning

1/ Early detection & Communication

2/ Assessment and Negotiation

3/ Follow-up communication

4/ Escalation

5/ Enforcement

6/ Resolution and closure

Maximize your collection effectiveness while improving your time to recovery

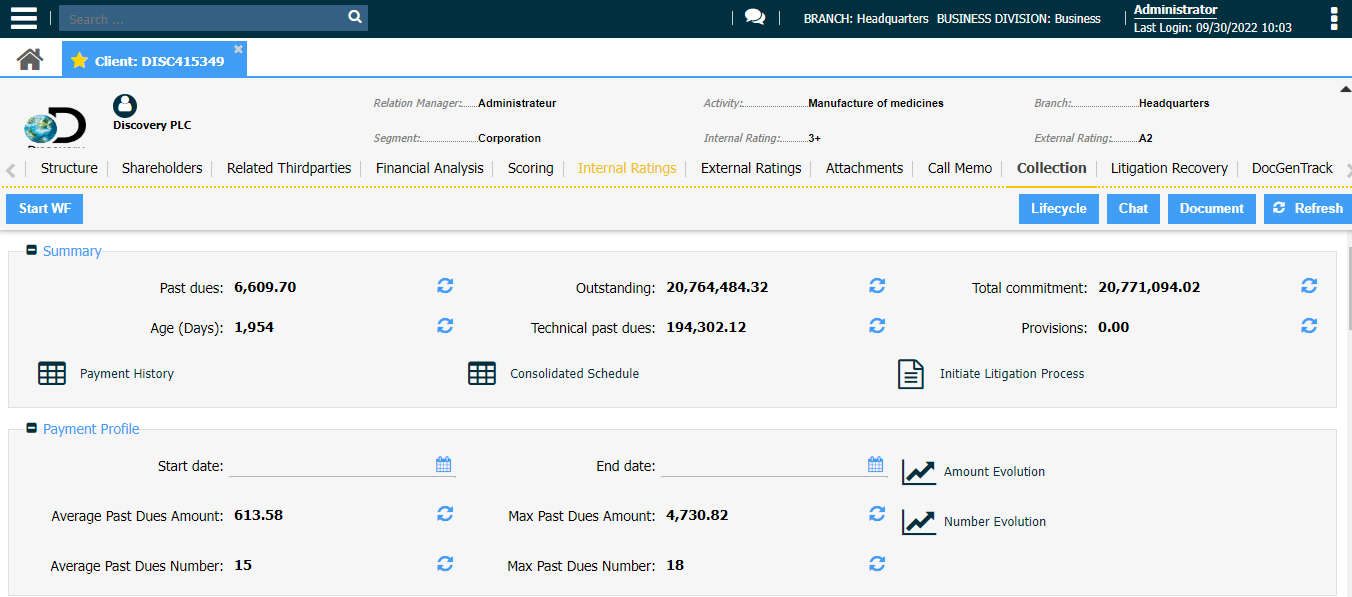

Streamline debt recovery with automated precision

- Follow up and manage triggered credit events via dedicated and fully configurable workflows.

- Customize various workflows according to “type of client”, “history”, “track record”, “amount past due”, circumstances such as first recovery, second, “first notice”, “escalation level”, “amount to recover”, etc.

- Perform portfolio aging and bucketing.

- Workflow-driven communication provides a better experience for borrowers leading to improved debt recovery.

Calculate your provisions as per internal group and regulatory standards (IFRS9)

- Identify and record changes in credit quality since origination

- Calculate general and specific provisions for performing, doubtful and impaired assets as per internal, group or IFRS9 rules

- Classify assets: stage 1, 2 and 3

- Integrate NPL data either manually within ACP or extracted from Core Banking or any other source system

- Host models and capture all inputs required for calculating ECL (Expected Credit Loss) and provisions: PD (12-month and Lifetime), LGD, Outstanding, CCF

- Closely monitor client credit worthiness trend and identify any increase in credit risk

- Benefit from your collateral portfolio quality when calculating your provisions

- Compare internal/group provisions vs. IFRS 9 calculations

Axe Credit Portal digital lending solution is trusted by