Solutions

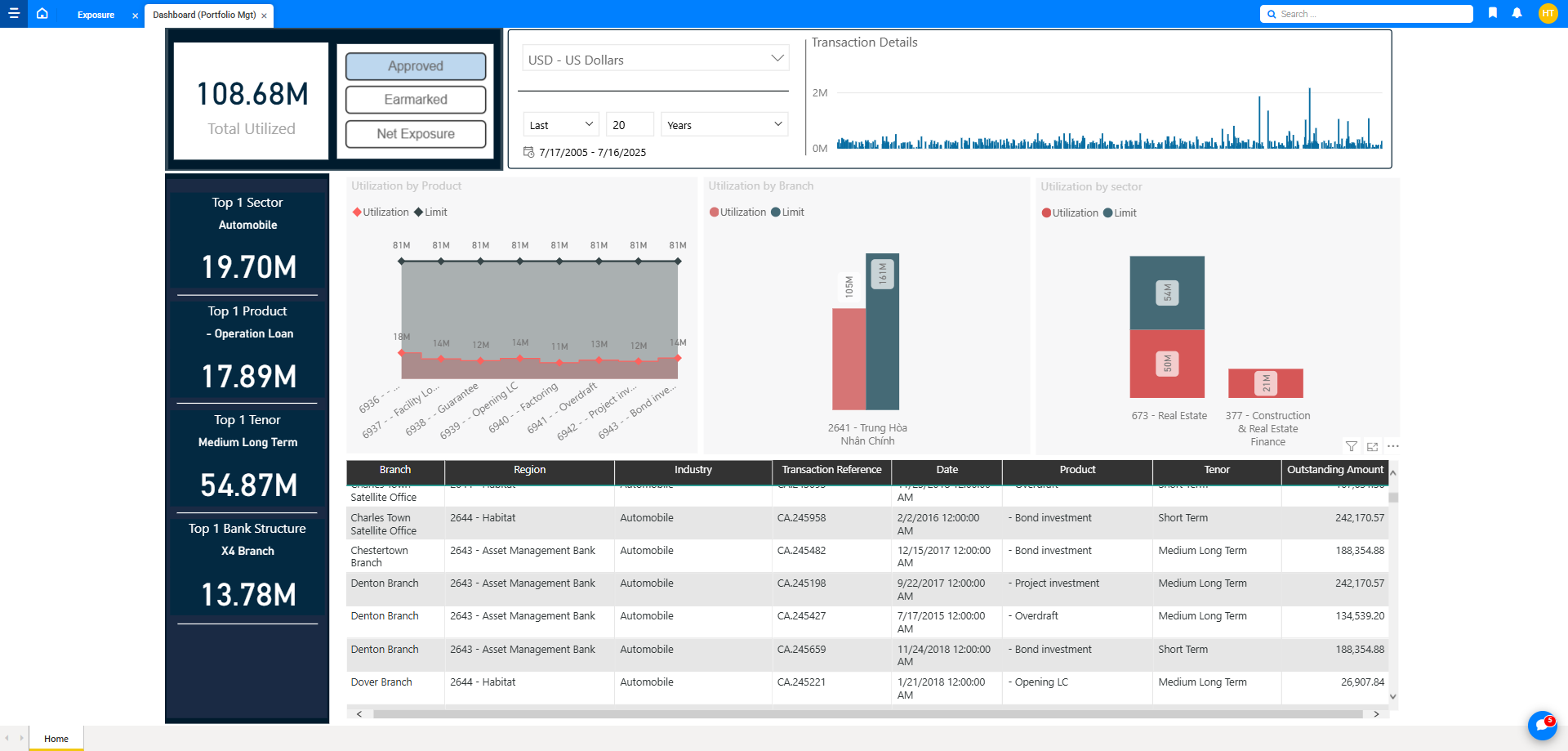

ACP Credit Portfolio Monitoring

As credit portfolios grow in complexity, many banks lose visibility across regions, segments, and regulations. ResearchGate (2024) links the lack of real-time monitoring to a 25% drop in risk accuracy and a 35% rise in incidents. Moody’s (2024) adds that active concentration risk tracking can cut capital charges by 21%. As portfolios grow more complex, real-time, integrated visibility is critical—yet many banks still operate in silos.

ACP Credit Portfolio Monitoring solves this with unified, AI-driven oversight that enhances foresight, automates compliance, and boosts resilience and performance.

1/ Pre-approval monitoring

2/ Post-approval monitoring

3/ Risk detection

4/ Behavioural analysis

5/ Portfolio health reassessment

6/ Strategic optimization

7/ Compliance

8/ Deployment

9/ Integrated limit and collateral management

Achieve proactive risk management and streamlined compliance with ACP Credit Portfolio Monitoring

A unified and seamless approach to credit portfolio monitoring

- AI-powered end-to-end portfolio monitoring solution

- Comprehensive automation across pre- and post-approval stages

- Real-time, integrated visibility across regions and segments

- Dynamic risk detection with predictive analytics

- Behavioural trend and exposure concentration monitoring

- Scenario-based portfolio stress testing and reassessment

- Automated compliance and governance-ready audit trails

Comprehensive automation of your credit portfolio monitoring

- Segment-specific risk models for Retail, SME, and Corporate portfolios

- Dynamic KPI/KRI thresholds and customizable exposure limits

- Zero-code workflows for agile rule updates

- Real-time dashboards integrating internal and external data

- AI-driven trend alerts and NLP-based sentiment scanning

Proactively detect and manage risks

- Behavioural trend monitoring and predictive breach indicators

- Exposure concentration heatmaps to visualize risk clusters

- Early warning system (EWS) audit trails for transparent governance

- Real-time anomaly detection to identify emerging risks

Reassess and optimize credit portfolio health

- Drill-down portfolio views for granular insights

- ML-based risk rating updates for dynamic borrower profiling

- Scenario-based stress testing and risk-adjusted profitability metrics

- AI-generated strategy recommendations for repricing or exit strategies

Strengthen capital efficiency and portfolio returns

- Real-time capital adequacy and volatility insights

- Risk-adjusted pricing tools to improve margins while maintaining quality

- Asset mix and exposure balancing to optimize risk-return

- Integrated limit and collateral management for dynamic risk control

ACP solution is trusted by