Solutions

ACP Multi-Entity Lending

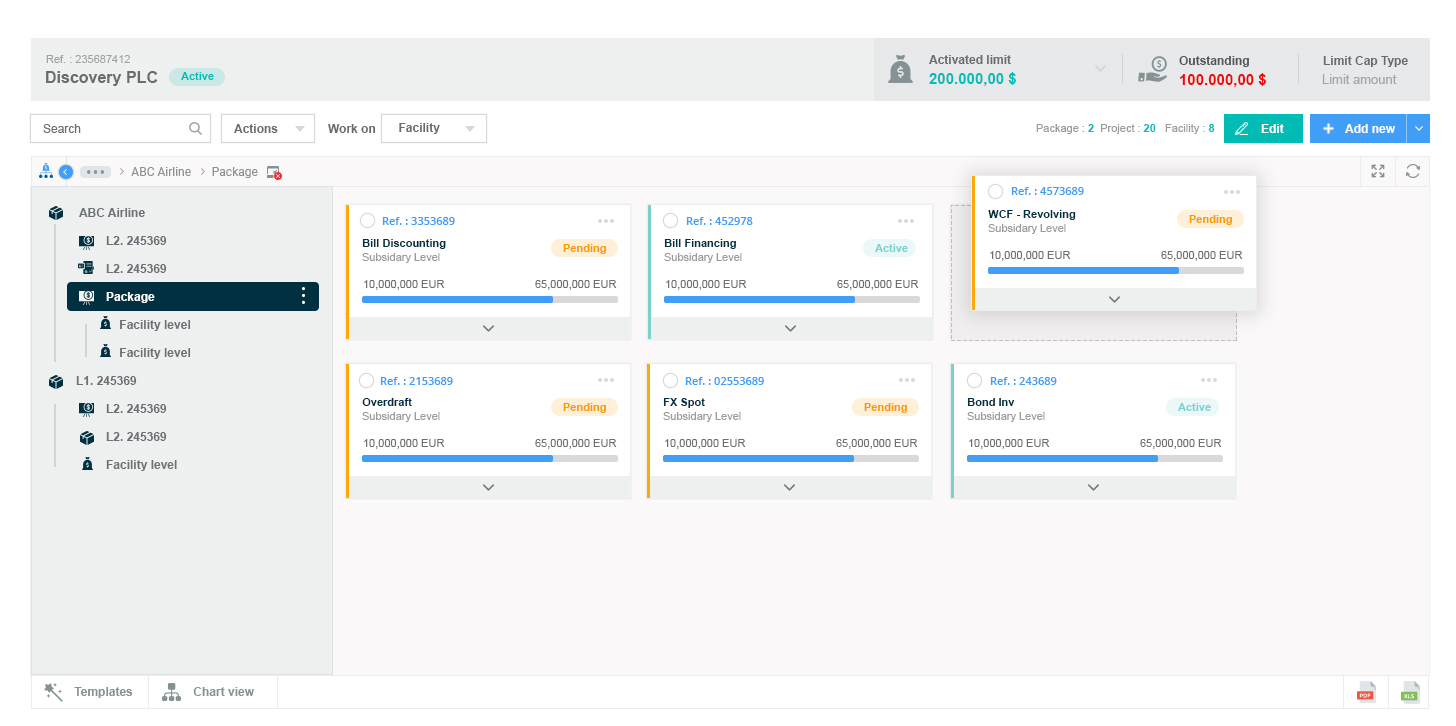

1/ Centralized and decentralized entity management

2/ Multi-currency and multi-language support

3/ AI-powered automation for credit processing

4/ Real-time, entity-specific credit decisioning

5/ Cross-entity compliance and data security

6/ Hybrid and multi-cloud deployment

7/ Role-based access control with global vs. local admin profiles

8/ Real-time consolidated reporting and analytics

9/ AI-based multi-entity risk monitoring

Achieve operational efficiency and elevate customer experience with ACP Multi-Entity Lending

Seamless multi-entity digital onboarding and unified credit workflows

- AI-enhanced onboarding & KYC with automated data synchronization: simplifies and standardizes borrower onboarding across entities, ensuring accurate and real-time data across branches and subsidiaries.

- Unified credit application processing & workflow orchestration: adapts intelligently to entity-specific requirements, with centralized processing, document handling, and credit disbursement optimization.

- Integrated multi-entity relationship & compliance management: enables cross-selling, centralized credit monitoring, and uniform compliance across jurisdictions.

- Cross-entity reference data standardization: ensures consistency and reliability in credit evaluation across jurisdictions.

- Unified financial template management: streamlines document collection and analysis across all entities.

Comprehensive multi-entity credit risk management with AI-powered insights

- Entity-specific risk modeling with unified credit scoring: customizes assessments for each entity while ensuring consistent scoring across the group

- Integrated, real-time risk data processing: combines internal/external sources and automates data extraction for complete and timely risk profiles.

- Predictive analytics and anomaly detection: enhances forecasting accuracy and flags irregularities in counterparty structures and exposures.

- Support for cross-entity counterparty structure management: enables full visibility over group-level exposures.

Proactive multi-entity portfolio monitoring with automated early warning systems

- Automated early warning systems and risk tracking: detects and flags risks across portfolios in real time using AI, pattern recognition, and NLP.

- Advanced delinquency alerts & collections optimization: streamlines risk mitigation and collection processes while maintaining regulatory compliance.

- Data-driven portfolio and performance analytics: delivers actionable insights and trend forecasting across multi-entity portfolios.

- Global search capabilities: enables users to search across clients, portfolios, and documents.

Multi-entity credit servicing and repayment management

- Centralized repayment tracking & interest management: manages schedules and calculations consistently across subsidiaries.

- Flexible loan restructuring: supports multi-entity clients by offering tailored products.

- Unified repayment visibility across counterparty structures: enables holistic tracking of repayments.

- Cross-entity collaboration tools & communication: enables unified borrower communication and internal chat functionality across entities to speed up credit operations.

Post-credit performance analytics and reporting

- Multi-entity performance tracking: provides insights on credit performance across business units.

- AI-powered loan portfolio forecasting: predicts future trends based on multi-entity data.

- Regulatory and internal reporting: automates reporting across jurisdictions to ensure compliance

- Standard ACP Dashboard Setup

- Cross-entity reporting capability

Axe Credit Portal is trusted by