SEGMENT

ACP EMBEDDED LOANS

Fostering bank partners' success with innovative financing solutions at the POS

AI-Powered Embedded Loan Solution, from KYC to Servicing

Ensure a prompt loan initiation On-the-go

- Instant digital onboarding powered by AI capabilities

- Tailor-made KYC forms for personalized Customer Experience

- Seamlessly initiate loans while browsing partner online/offline shops or mobile apps

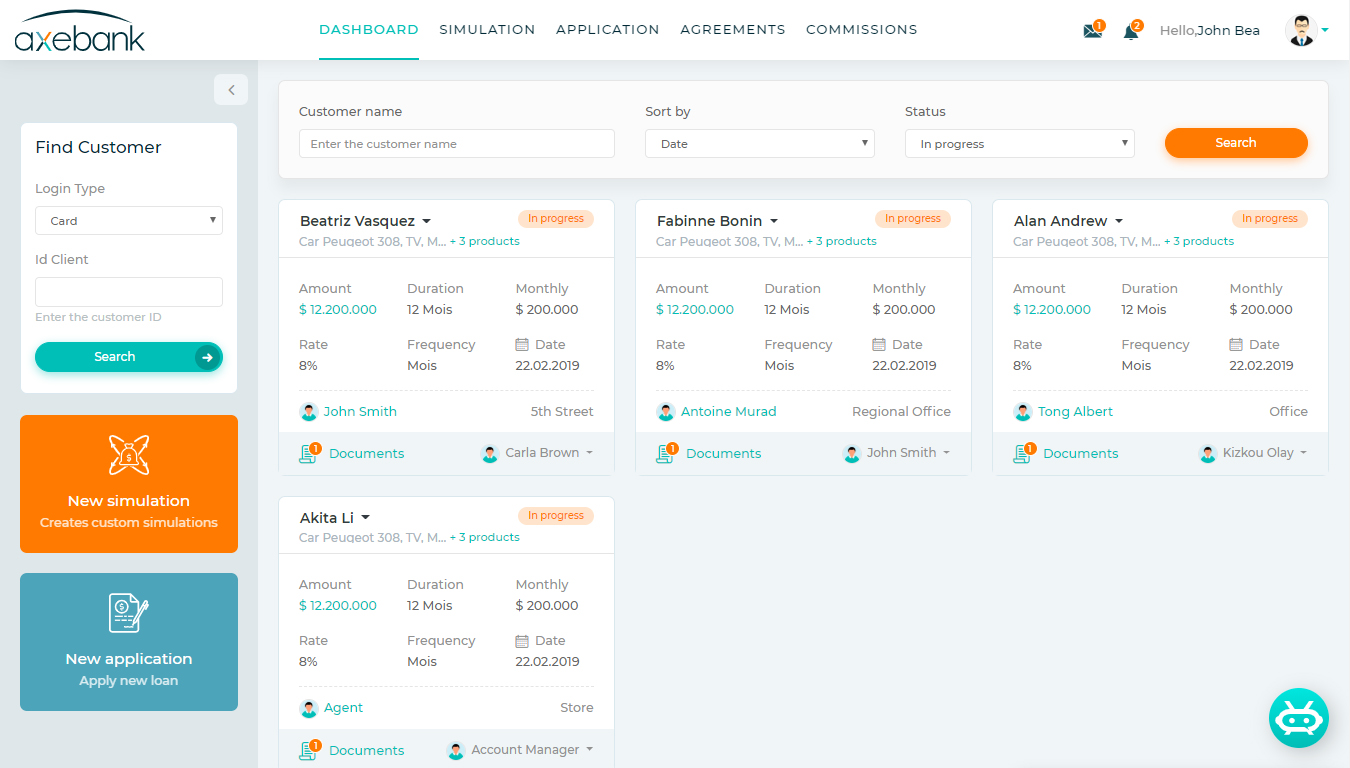

- Effortlessly originate loans through ACP embedded loans workspace or Integrated Sales/CRM/KYC Platforms

- Convenient On-the-Go document submission for all parties across every channel

Empowering accurate credit decisions with combined traditional & AI-based scoring

- Tailored pricing and approval workflows aligned with partner industry verticals

- Seamless risk mitigation enabled by ACP Embedded Loans loan eligibility rules

- Robust APIs for data integration with external and internal databases, ensuring GDPR compliance and regulatory alignment

- Automated generation of credit terms and conditions according to bank policies and partner agreements

Maximizing Embedded Loan Monitoring and Cross-Selling with Advanced Data Analytics

- Elevate customer engagement with personalized mobile push notifications throughout the financing journey

- Gain holistic insights into partner activity through comprehensive 360° dashboards, covering pending CAs, disbursed loans, and rejected CAs

- Harness the power of ACP Embedded Loans to store CAS data for generating insightful reports, facilitating scoring, and identifying cross-selling opportunities

ACP Embedded Loans is trusted by

What is Embedded Financing?

How does embedded finance differ from peer-to-peer financing (P2P)?

P2P lending platforms connect individual borrowers with individual lenders outside traditional banks, whereas embedded finance seamlessly integrates financial services into non-financial products or platforms. Thus, while both involve financial transactions, they operate differently within their respective contexts.