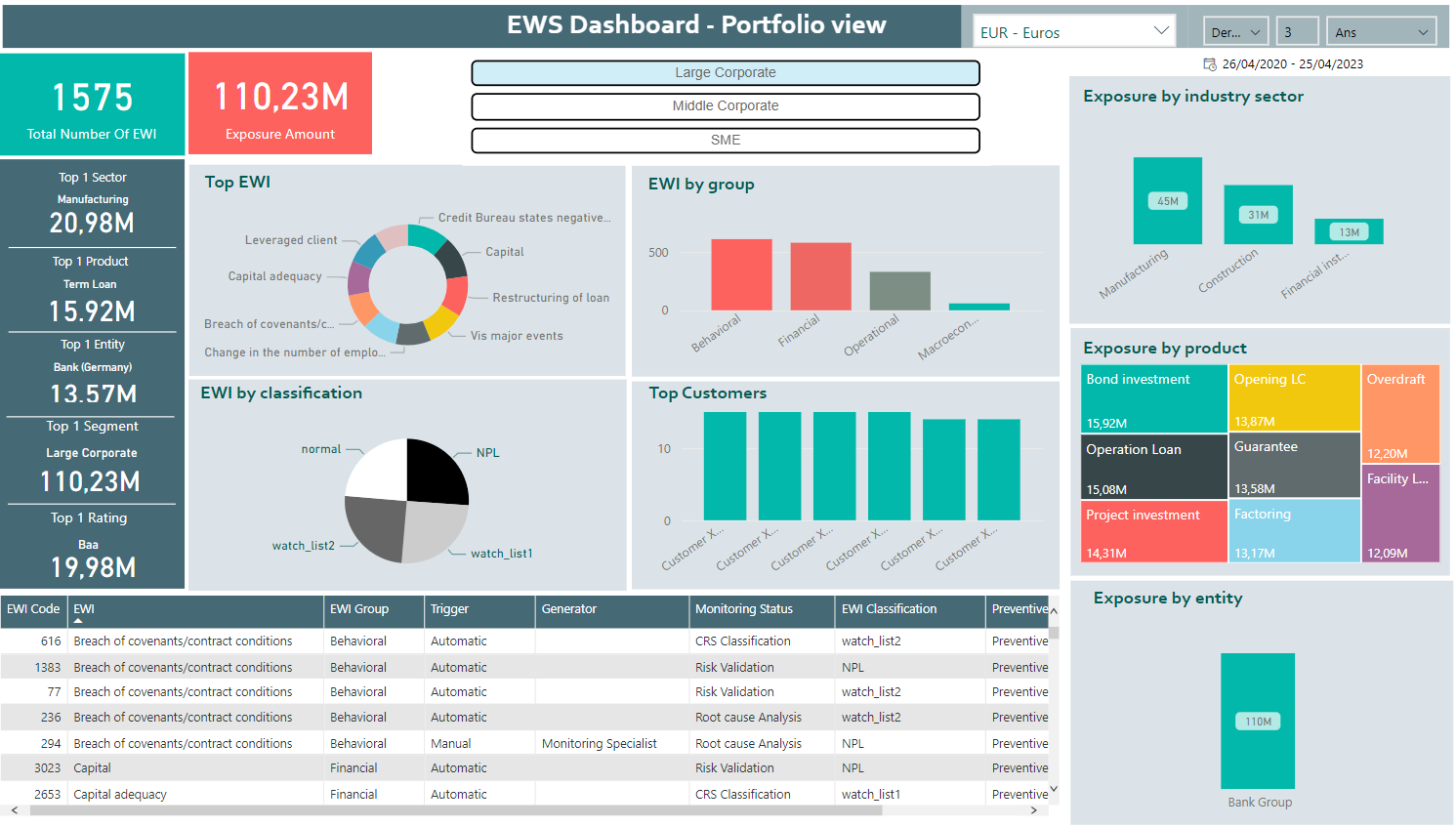

Why is an Early Warning System important in lending?

Late detection of deteriorating creditworthiness reduces mitigation options and increases the likelihood of losses. An Early Warning System (EWS) enables lenders to move from a reactive to a proactive approach, spotting risks before they escalate. By continuously monitoring borrower behaviour, financial transactions, and external signals, lenders can intervene early, improve portfolio resilience, and reduce delinquency rates.

What types of data does the ACP Early Warning System analyse?

ACP EWS processes both structured and unstructured data at scale. This includes transactional records, financial statements, payment histories, customer demographics, account activity, ATM transactions, and even external data sources such as news or filings. Advanced analytics techniques like Natural Language Processing (NLP), clustering, and predictive modelling help uncover subtle behavioural shifts and emerging risks that traditional monitoring may miss.

How does ACP Early Warning System integrate with existing credit operations?

ACP EWS is embedded into the Axe Credit Portal ecosystem and can be seamlessly connected to existing lending workflows via APIs. This allows real-time monitoring, alerts, and remediation steps to feed directly into loan servicing, collection, and portfolio management systems without disrupting established processes. Lenders can tailor thresholds, workflows, and dashboards to match their specific risk policies and operational requirements.