What is Islamic Banking

Also known as Islamic finance or sharia-compliant banking, Islamic Banking operates according to the principles of Islamic law (Sharia) and prohibits the payment or receipt of interest (riba). Instead of traditional interest-based lending, Islamic banking follows ethical and religious guidelines that promote fairness, transparency, and social responsibility. It continues to grow as a significant segment of the global banking industry, serving both Muslim and non-Muslim customers who seek ethical and socially responsible financial solutions.

How does automation streamline Sharia-compliant financing processes such as Mudarabah and Musharakah?

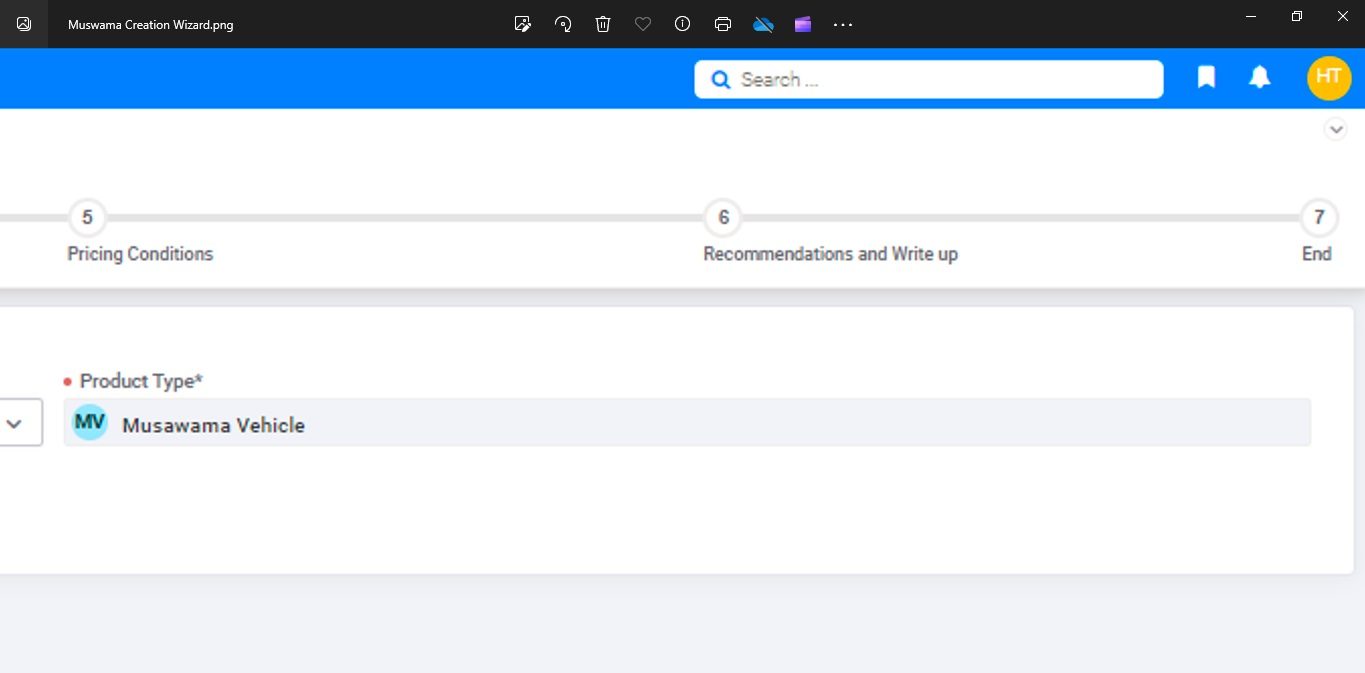

Automation streamlines Sharia-compliant financing processes such as Mudarabah and Musharakah by digitizing documentation, automating contract creation, facilitating real-time profit-sharing calculations, and ensuring compliance with Sharia principles throughout the transaction lifecycle.