Solutions

ACP Loan collectors

for synergistic debt recovery partnerships

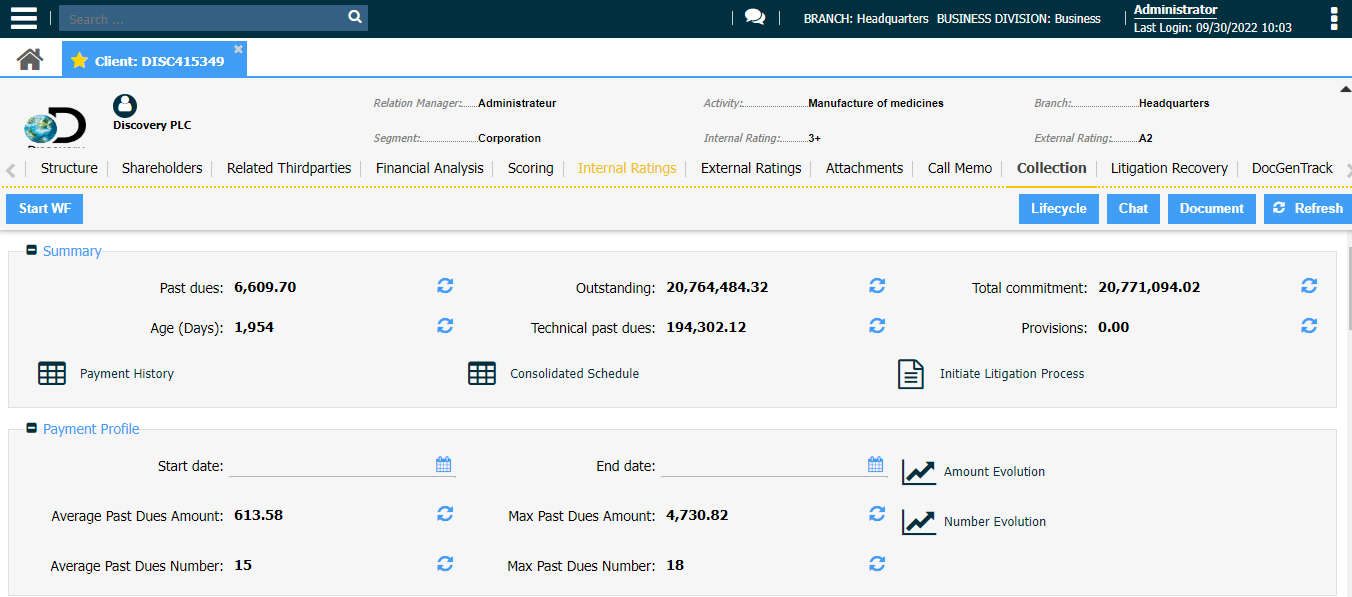

ACP Collectors solution tackles these issues through automated debt recovery, streamlining tasks like data entry and document processing. ACP's Open Lending architecture enables direct access for debt collectors to manage debt collection activities alongside banks on the same ACP partner platform with the same database. This integrated approach fosters real-time collaboration, reduces debt collection operational costs, and orchestrates an efficient, workflow-driven communication with customers.

Maximize your collections potential and mitigate risks efficiently

Effortless and smarter recovery optimization through AI

Maximize your collection efficiency and streamline management of delinquent accounts

- Automated communication capabilities

- Communicate instantly with customers and internal bank stakeholders through multiple channels.

- Automated workflow driven loan collections

- Ensure data quality & consistency

- Minimize manual processing

- Documentation attachment and generation based on the loan collector templates

- Data traceability through workflows

- Ensure data consistency with business rules, mandatory fields, calculated fields, etc.

- Dashboards and dynamic collection reports

Workflow-driven communication and efficient debt recovery follow up

- Real-time data integration with external and internal data sources

- Collection prioritization through risk scores

- Automated delegation of authority as per the institution’s credit policy

- Tracking & monitoring: collaterals, covenants, conditions, and internal risk triggers

Integrated options (EWS & Servicing)

- Customer-tailored repayment options

- Efficient monitoring of loan profitability by generating & recording accounting entries for each event

- Real-time communication between the bank and the loan collector

- Better risk mitigation and reduced number of defaults through AI-based early warning signals

ACP digital lending is trusted by

Who are loan collectors?

How loan collectors can leverage automation?

They benefit from automated and streamlined communication channels, such as email, SMS, or voice messaging, to send reminders, payment notifications, and follow-up messages to borrowers, reducing the need for manual outreach. Automated payment processing improves collection efficiency, while data analytics and predictive modeling help assess borrower behavior, predict delinquency risk, and prioritize collection efforts.

Automation also allows for the streamlining of repetitive tasks and workflows, such as account segmentation, payment processing, and document generation, increasing operational efficiency and freeing up staff time for more strategic tasks. Additionally, automating compliance checks, documentation processes, and audit trails minimizes the risk of non-compliance.

Thanks to ACPs, loan collectors can streamline their loan collection processes, improve efficiency, reduce operational costs, and enhance the overall borrower experience.