SOLUTIONS

ACP loan servicing software

1/ Fetching Customer Active Contracts

2/ Loan Servicing Event

3/ New Servicing terms & Conditions Simulation

4/ Documents attachement & Write ups

5/ Approval & Activation Process

6/ Reports & Servicing Monitoring

Covering every step of the loan servicing process

Comprehensive multi-segment loan servicing solution

Autopilot Loan Servicing through a comprehensive automation of all post approval events

ACP allows the automation of all post-approval events:

- Early settlement (full/partial)

- Re-negotiation

- Installment deferral

- Restructuring

- Rescheduling

- Consolidation

- Write-off/Write-down

- Limits reallocation

- Events on collateral/guarantee

- Overdraft interest calculation

- Repayment feedback and billing settlement

- Classification/declassification (Loans & counterparty)

- Past due penalty calculation

- Interest/amortized fees accruals

- Variable rate change impact

- Mitigant value adjustment

Smart automation covering every step of the loan servicing process

- Automated steps on all loan servicing events.

- Communicate instantly with customers and internal bank stakeholders through multiple channels.

- Customized loan servicing dashboards to track full portfolio performance and monitor reports.

Built-in accounting and batch engines for a flawless 24/7 processing

- Automated accounting process for all loan servicing events (single and batch events).

- Efficient monitoring of loan profitability by generating & recording accounting entries for each event.

- Real-time communication between CBS and ACP Loan Servicing accounting engine.

- Efficient risk mitigation and anticipation of borrowers’ needs through daily batch processing.

- Configurable accounting engines as per local regulations thanks to a multi-chart of account schemes.

- Complete self-sufficiency through drag-and-drop, zero-code GUI configurations.

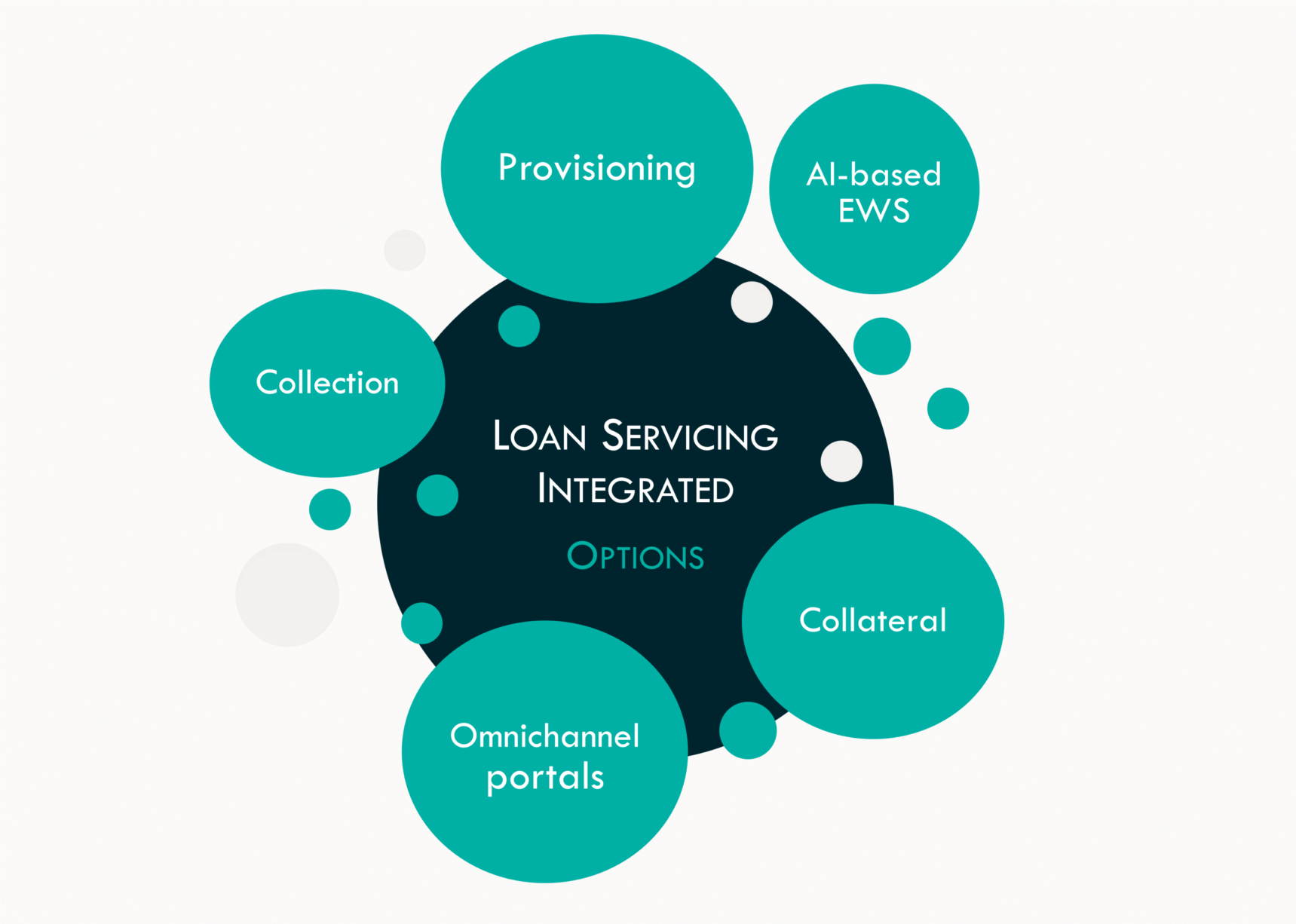

Integrated Options for Enhanced Loan Servicing

- Enhanced risk mitigation and lower default rates with AI-driven Early Warning Systems (EWS).

- Improved collections efficiency and higher recovery rates facilitated by ACP Collection and Recovery.

- Accurate provisioning calculations with comprehensive input capture.

- Automated collateral valuation aligned with bank policies and centralized portfolio management.

- Seamless, real-time customer experience across all platforms enabled by ACP Omnichannel.

- Effortless interactions across various devices for a low-touch experience.

Axe Credit Portal is trusted by :