Solutions

ACP OMNICHANNEL

1/ Credit application Initiation

2/ Documents upload

3/ Credit Risk assessment

4/ Multi-channel notifications

5/ Digital contract signature

6/ Disbursement and servicing

Digital lending orchestrated across all channels

A robust set of APIs for seamless open lending journeys

ACP Omnichannel Banking Solution combines ACP Business Services designed around the following four building blocks:

- wACP: composed of fine-grained business service components enabling lenders to craft omnichannel financing journeys.

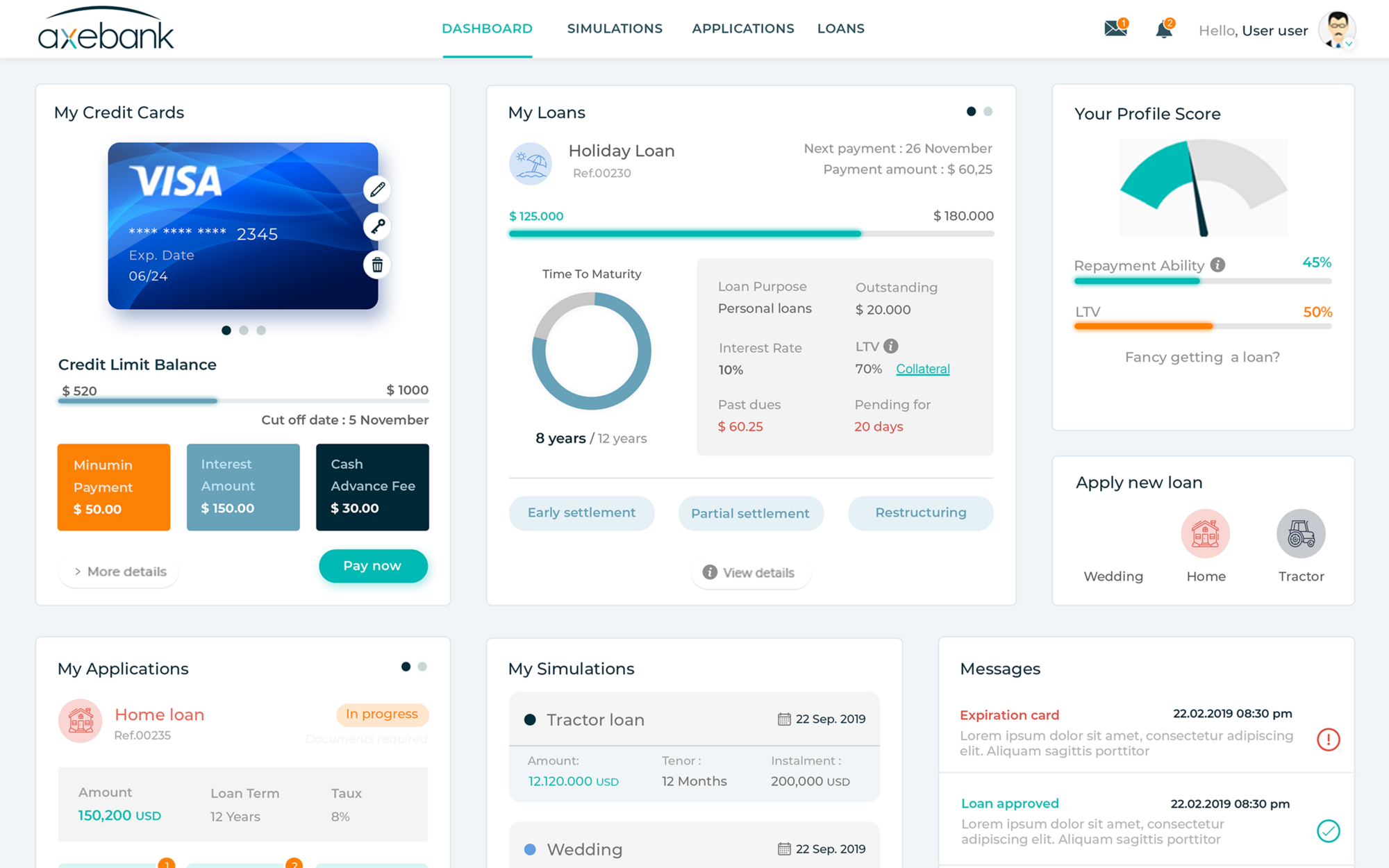

- myACP: is the customer portal access (mobile & web) to credit products offered by the bank or the partner.

- mACP: is the mobile application dedicated to bankers who use ACP’s main functions through their mobile devices.

- pACP: is the bank’s front-end access (mobile & web) for partners, credit distributors, and external stakeholders, enabling them as digital credit enablers and unlocking new channels and revenue streams.

Mitigated risk and consistent credit processes through multiple devices, channels, & stakeholder

ACP Omnichannel’s robust set of APIs allows credit stakeholders to perform their duties over multiple touchpoints of the credit lifecycle, a credit application can be:

- Launched by a partner through pACP.

- Assessed by the bank relationship manager through ACP.

- Approved by the decision maker through mACP.

- Contractually and digitally signed by the customer through myACP.

- Automatically sent to the Core Banking System for disbursement.

Orchestrated interactions across all channels for an open lending journey

- Built-in chat feature allowing the bank users to exchange messages within the context of the CA.

- Loan simulator: the simulation engine can be made available to help fine-tune loan pricing.

- Quick loan origination and credit application status tracking.

- Generation and credit documentation downloads.

- Review, attach, and download credit application-related documents.

- Eligibility rules for precise product offers in compliance with internal credit policies and regulations.

- Illustration of the credit application limit structure.

- Global and quick search options.

- Streamlined workflow tasks across all channels

- Push notifications across all devices.

Axe Credit Portal is trusted by