What is loan origination software?

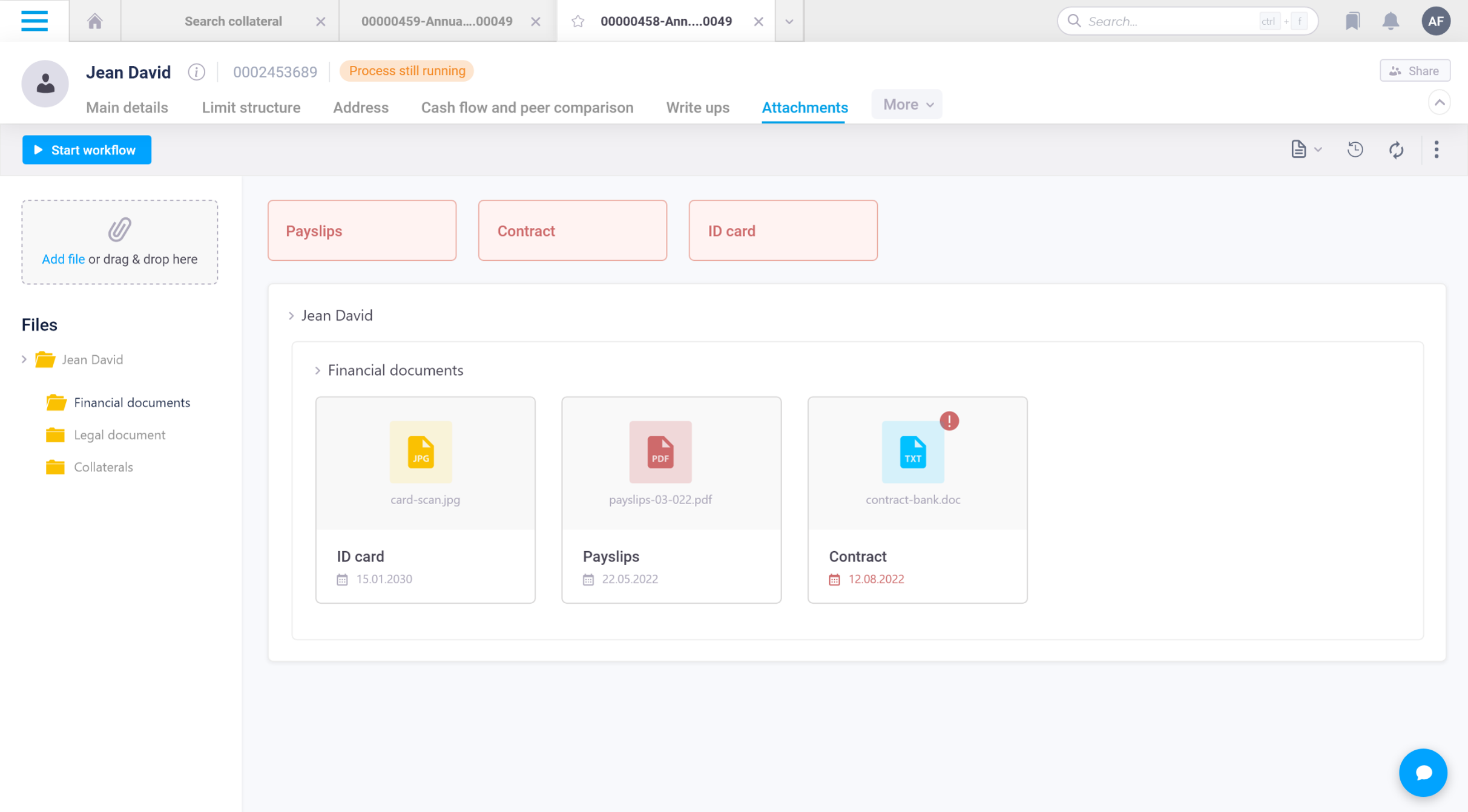

Loan origination softwares, such as Axe Credit Portal (ACP), is a digital platform designed to automate and streamline the lending process for banks and financial institutions. ACP facilitates end-to-end loan origination, from KYC, approval, scoring and decisioning and up to servicing, enhancing operational efficiency and improving borrower satisfaction.

How can loan origination software benefit financial institutions?

An AI-powered digital lending solution, such as ACP, offers numerous benefits to banks and financial institutions, including accelerated loan processing, reduced operational costs, enhanced risk management, improved compliance, and increased customer satisfaction. By leveraging the latest AI innovations to automate manual tasks and integrating with existing systems, ACP empowers lenders to make faster, more informed lending decisions while minimizing risk.

What level of customization and flexibility does the tool offer to adapt to our specific lending practices and requirements ?

From adjusting workflow processes to modifying decision-making criteria, the configuration tools provide granular control over every aspect of the lending lifecycle. With intuitive drag-and-drop interfaces and configurable parameters, you can easily configure rules, templates, and workflows to align with the bank’s specific changing needs. Additionally, the tool supports dynamic adaptation, allowing you to evolve and refine your lending practices over time without extensive redevelopment