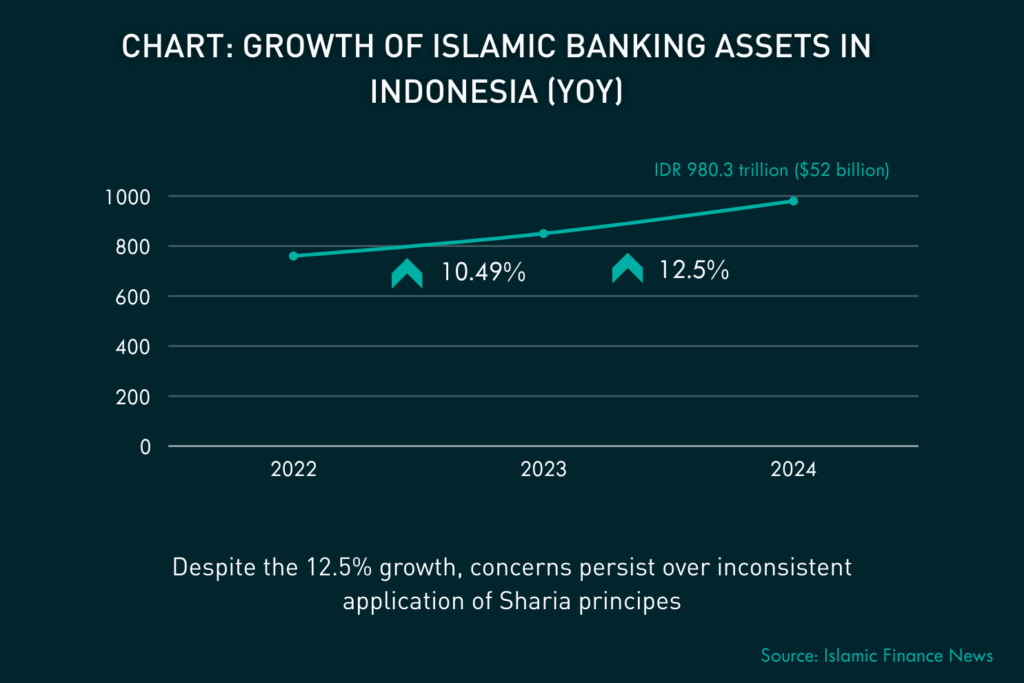

Islamic finance is gaining strong momentum across Southeast Asia. In Indonesia, the sector is already well-established and expanding rapidly. As of August 2024, Islamic finance assets reached IDR 2,742 trillion (approximately USD 152.4 billion), marking a 13% year-on-year increase. A significant share of this growth comes from Islamic banks, whose assets total IDR 980.3 trillion.

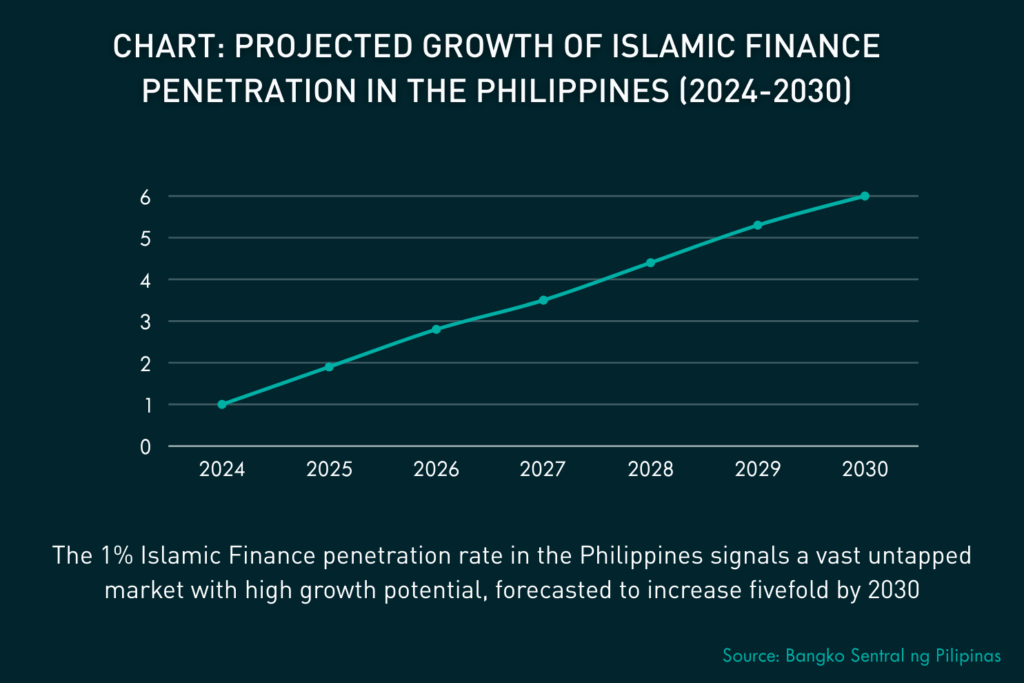

In the Philippines, interest in Islamic finance is accelerating. A recent ADB survey revealed that 78% of Filipinos are open to using Sharia-compliant financial services. In response, regulators are enabling both rural and commercial banks to offer Islamic products, laying the groundwork for broader adoption.

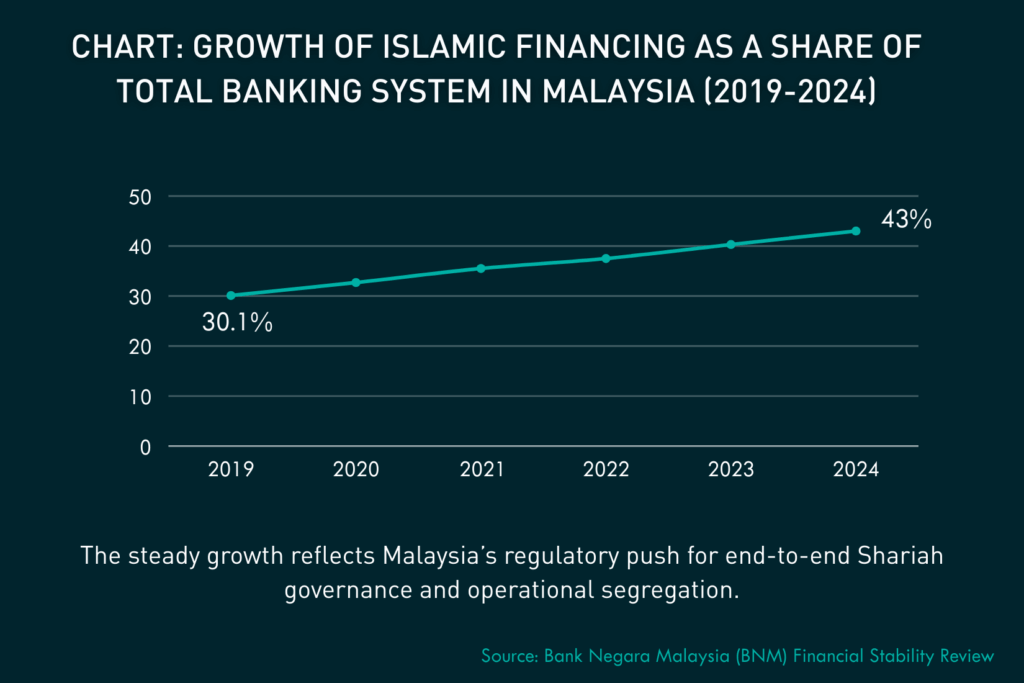

In Malaysia, Islamic banking continues to evolve under a mature and well-regulated ecosystem. With Islamic financing now comprising 43% of total banking system loans by the end of 2024, the country is reinforcing its leadership in the global Islamic finance space through a wave of new regulatory reforms.

This evolving landscape presents both a major opportunity and a set of complex challenges in compliance, operations, and credit risk.

Indonesia: Strengthening Sharia Oversight

In early 2024, Indonesia’s Financial Services Authority (OJK) introduced Regulation No. 2/2024 on Sharia Governance. This regulation enhances internal controls across Islamic financial institutions, especially in the structuring of financing products such as murabahah (cost-plus sale), ijarah (leasing), and mudharabah (profit-sharing).

Key directives include establishing dedicated Sharia compliance units, maintaining robust documentation, conducting independent contract validations, and implementing stronger internal oversight from Sharia Supervisory Boards (SSBs).

Challenges for Indonesian Banks

1. Elevated Compliance Demands:

Banks must embed Sharia principles into their core lending processes, requiring redesigns of product templates, approvals, and audit trails. This often entails significant investment in training and system upgrades.

2. Diverse Sharia Interpretations:

Despite regulatory efforts toward standardization, inconsistent interpretations of Sharia across institutions continue to create legal uncertainty and delay product launches.

3. Operational Resource Strain:

Banks, especially those with both conventional and Islamic divisions, are under pressure to enhance compliance capabilities without significantly increasing headcount or costs. Manual processes and fragmented data further slow origination and risk assessment.

Philippines: Laying the Groundwork for Islamic Banking

The Bangko Sentral ng Pilipinas (BSP) is taking decisive steps by allowing conventional banks to establish Islamic Banking Units (IBUs). Under the Islamic Banking Act of 2019, this initiative aims to introduce offerings like qard al-hasan (benevolent loans), mudarabah-based investments, and other Sharia-compliant products.

By Q1 2025, several universal banks intend to pilot Islamic lending products, especially in underserved Muslim-majority regions such as Mindanao. To support this shift, the BSP is also developing a Sharia-compliant liquidity management facility, addressing a long-standing barrier to broader Islamic finance adoption.

Challenges for Philippine Banks

1. Institutional Knowledge Gaps:

Most conventional banks lack experience in Islamic finance. The absence of standardized templates and skilled personnel hinders their ability to rapidly deploy new products.

2. System and Infrastructure Limitations:

Integrating IBUs into traditional banking frameworks poses challenges. Core systems often cannot accommodate profit-sharing or non-interest-based financing structures.

3. Legal and Regulatory Ambiguities:

While BSP is proactive, the supporting legal and tax framework for Islamic contracts remains underdeveloped. Issues like the enforceability of ijarah muntahiya bi tamlik (lease-to-own) contracts continue to limit investment.

Malaysia: Strengthening Islamic Banking Through Regulatory Reforms

Malaysia’s Islamic banking sector continues to grow, with Sharia-compliant financing reaching 43% of total banking system loans by end-2024. This growth is supported by Bank Negara Malaysia’s (BNM) regulatory push to enhance governance and risk resilience.

Key measures include new requirements for Islamic Banking Windows (IBWs), mandating dedicated divisions with separate capital and funds. BNM also introduced standardized frameworks for Islamic repo transactions—such as SBBA and Collateralized Commodity Murabahah (CCM)—and stricter rules on the disposal of impaired loans, emphasizing borrower protection and tighter eligibility for buyers. Together, these reforms aim to strengthen operational segregation and end-to-end Shariah compliance.

Implications for Malaysian Banks

1. Operational Segregation:

Banks must maintain clear separation between Islamic and conventional operations, including distinct governance, capital allocation, and compliance processes.

2. Shariah Governance:

Institutions are required to embed Shariah principles into their business strategy, supported by qualified advisors and internal compliance mechanisms.

3. Risk Management:

Stronger internal controls and reporting systems are needed to manage Shariah-specific risks and ensure ongoing regulatory compliance.

Digital Lending as a Strategic Enabler :

With regulations evolving across Indonesia, Malaysia, and the Philippines, financial institutions need to balance agility, scale, and Sharia compliance. A well-designed digital lending platform can be a critical asset—streamlining operations while meeting regulatory and religious mandates.

Key Capabilities Required:

/ Zero-Code Sharia Product Builder: Create murabahah, ijarah, or mudarabah offerings tailored to local Sharia interpretations in total self-sufficiency, without coding or extended development cycles.

/ End-to-End Sharia Governance Workflow: Automatically route transactions through SSB (Sharia Supervisory Board) approval, with built-in compliance checks and audit-ready documentation.

/ Rule-Based Compliance Engine: Intelligent engines to detect and prevent non-compliant elements like riba (usury) and gharar (uncertainty), throughout the product lifecycle, from origination to disbursement, ensuring continuous adherence to Islamic principles.

/ AI-Driven Risk Monitoring: Machine learning capabilities that identify early stress signals in complex Islamic structures such as musharakah or mudarabah, supporting proactive portfolio management.

/ Multi-Entity Flexibility: Accommodate Islamic windows and fully Sharia-compliant institutions with adaptability to country-specific regulations, including OJK and BSP guidelines.

/ Rule-Based Compliance Engine: Allow conventional banks to launch Islamic Banking Windows (IBWs) within a unified platform, with operational segregation across products, rules, capital, reporting, and Shariah workflows.

Why Axe Credit Portal (ACP Islamic Banking solution) is the Right Fit:

ACP is purpose-built to support digital Islamic lending at scale. Its modular architecture integrates all essential components financial institutions need to digitalize their Islamic credit operations—without compromising on compliance, agility, or Shariah integrity.

Across Southeast Asia, ACP adapts to country-specific regulatory landscapes: from embedding Sharia governance workflows and contract validations in compliance with Indonesia’s OJK mandates, to enabling Islamic Banking Units (IBUs) under the BSP framework in the Philippines, and supporting Malaysia’s operational segregation, Islamic collateralised funding structures, and enhanced disposal protocols under BNM’s evolving policies.

With tools like axeBRM for rule automation and axeStudio for low/no-code configuration, ACP ensures banks can quickly implement local requirements such as Sell and Buy Back Agreements (SBBA), Collateralized Commodity Murabahah (CCM), borrower protection rules, and dual banking operations—while maintaining full auditability and transparency.

A strong endorsement comes from Al Rajhi Bank, one of the largest Islamic banks in the Middle East. After rigorous evaluation, Al Rajhi selected ACP to modernize its lending across corporate, SME, and institutional segments. The platform now drives faster origination, complex collateral management, and seamless integration—resulting in improved operational performance and compliance outcomes. Al Rajhi Bank’s Digital Transformation in Islamic Lending.