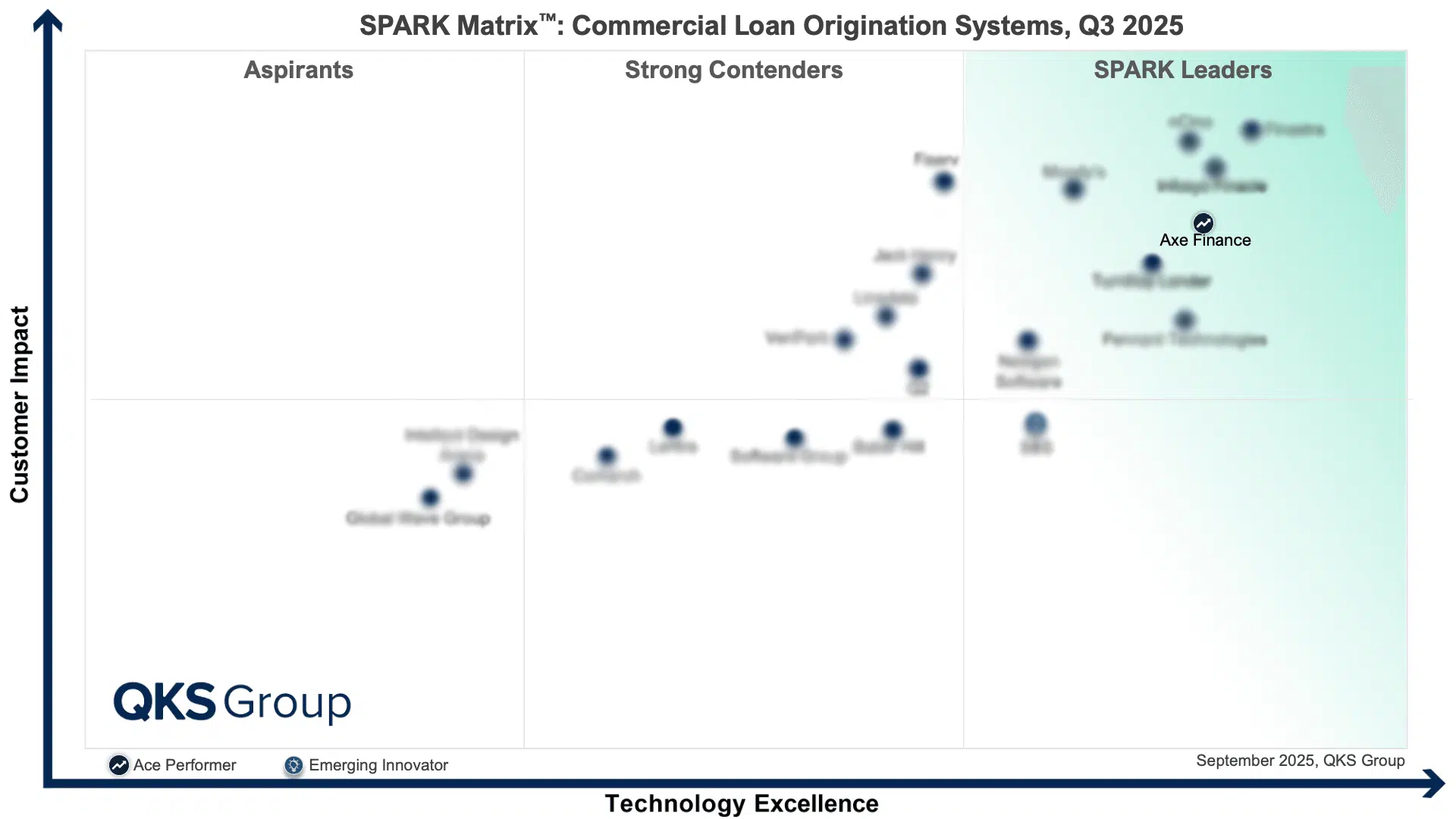

- The QKS Group SPARK Matrix™ provides competitive analysis & ranking of the leading Loan Origination vendors.

- Axe Finance, with its unified ACP platform, has received strong ratings across technology excellence and customer impact.

October 2025: QKS Group announced today that it has named Axe Finance as a Leader and Ace Performer* in the SPARK Matrix™: Commercial Loan Origination Systems, Q3 2025.

Recognition

Akhilesh Vundavalli, Principal Analyst at QKS Group, states, “Axe Finance is reshaping commercial and corporate lending through an automation-first, risk-intelligent approach that unifies credit governance, compliance, and decisioning within a single digital ecosystem. Its ACP Commercial Lending platform digitizes the entire corporate credit lifecycle while embedding AI-driven analytics for predictive risk surveillance and performance forecasting. Equipped with advanced modules for limit and collateral management, early warning systems, and risk-aware pricing, the platform delivers real-time visibility into exposures, covenant health, and profitability at the facility level. With these capabilities, Axe Finance is driving the transition toward transparent and efficient commercial loan origination.”

The QKS Group SPARK Matrix™ includes a detailed analysis of the global market dynamics, major trends, vendor landscape, and competitive positioning. The study also provides a competitive analysis and ranking of the IT Service Management Tools providers in the form of the SPARK Matrix™. The study also provides strategic information for users to evaluate different vendor capabilities, competitive differentiation, and market positions.

*Ace Performer : Ace Performers are vendors that excel in operational performance based on their revenue growth potential, partnership strategy, and customer acquisition—all evaluated over the last one-year period or since the previous SPARK Matrix assessment.

Quote by Axe Finance’s Chief Marketing Officer:

“We are honoured to be recognised once again as leaders by QKS Group in its 2025 SPARK Matrix for Commercial Loan Origination Systems. This recognition validates our automation-first, risk-intelligent approach to commercial and corporate lending and highlights how our unified Axe Credit Portal (ACP) platform helps financial institutions digitise the entire credit lifecycle. By embedding AI-driven analytics, predictive risk surveillance, and advanced collateral and limit management directly into the origination process, ACP empowers banks to strengthen credit governance, enhance compliance, and achieve real-time visibility across exposures and profitability. This award underscores our position as a trusted global provider of cutting-edge credit origination solutions and our commitment to supporting the evolving needs of the commercial lending market.”

Commentary:

In 2025, the commercial loan origination system (CLOS) market is defined by automation, predictive intelligence, and compliance readiness. Banks face rising credit complexity and tighter regulations under Basel III, IFRS 9, and CECL—pressures that legacy systems can’t keep up with.

Modern CLOS platforms are API-first and AI-driven, integrating with core banking and external data sources to streamline onboarding, risk assessment, and portfolio monitoring. They embed automated reporting, covenant tracking, and ESG scoring, while offering cloud scalability, advanced dashboards, and omnichannel engagement.

As the 2025 SPARK Matrix highlights, leaders like Axe Finance are unifying origination, governance, and intelligence into a single ecosystem—helping institutions manage risk, ensure compliance, and compete more effectively in a fast-changing credit landscape.

Additional Resources:

- For more information about Axe Finance, visit here

- SPARK Matrix™: Retail Loan Origination Systems, Q3 2025

About Axe Finance:

Founded in 2004, Axe Finance is a global market-leading software provider focused on credit risk automation for lenders looking to provide an efficient, competitive, and seamless omnichannel journey.

Axe Finance developed the Axe Credit Portal (ACP) a future-proof AI-driven solution to automate the entire credit lifecycle from KYC to servicing, including origination, credit scoring, and automatic decision-making. ACP is a multi-segment digital lending solution covering not only Retail, Commercial, Corporate, FIs, and Sovereign segments but also other specific types of lending such as Microfinance, BNPL, embedded financing, and Islamic finance. Axe Finance is the trusted partner of reputable banks worldwide such as Société Générale, OTP, Al Rajhi Bank, ADCB, FAB, BBK, Bangkok Bank Limited, and Polaris Bank.

For more information about Axe Finance

Media Contacts:

Email: marketing@axefinance.com

About QKS Group

QKS Group is a global analyst and advisory firm helping enterprises, technology vendors, and investors make trusted, data-driven decisions. Our portfolio spans the flagship SPARK Matrix™ evaluation framework, SPARK Plus™ analyst advisory platform, QKS Intelligence™ for market and competitive tracking, and QKS Community™ for CXO leaders and practitioners. All offerings are powered by a Human-Intelligence-driven framework and QKS’s closed-loop research methodology – integrating expert-led insights, quantitative modeling, and continuous validation to deliver credible, outcome-focused intelligence.

For more available research, please visit Research

Media Contacts:

Shraddha Roy

PR & Media Relations

QKS Group

5th Floor, Wing 2, Cluster C,

EON Free Zone, Kharadi,

Pune, India

Email: shraddha.r@qksgroup.com