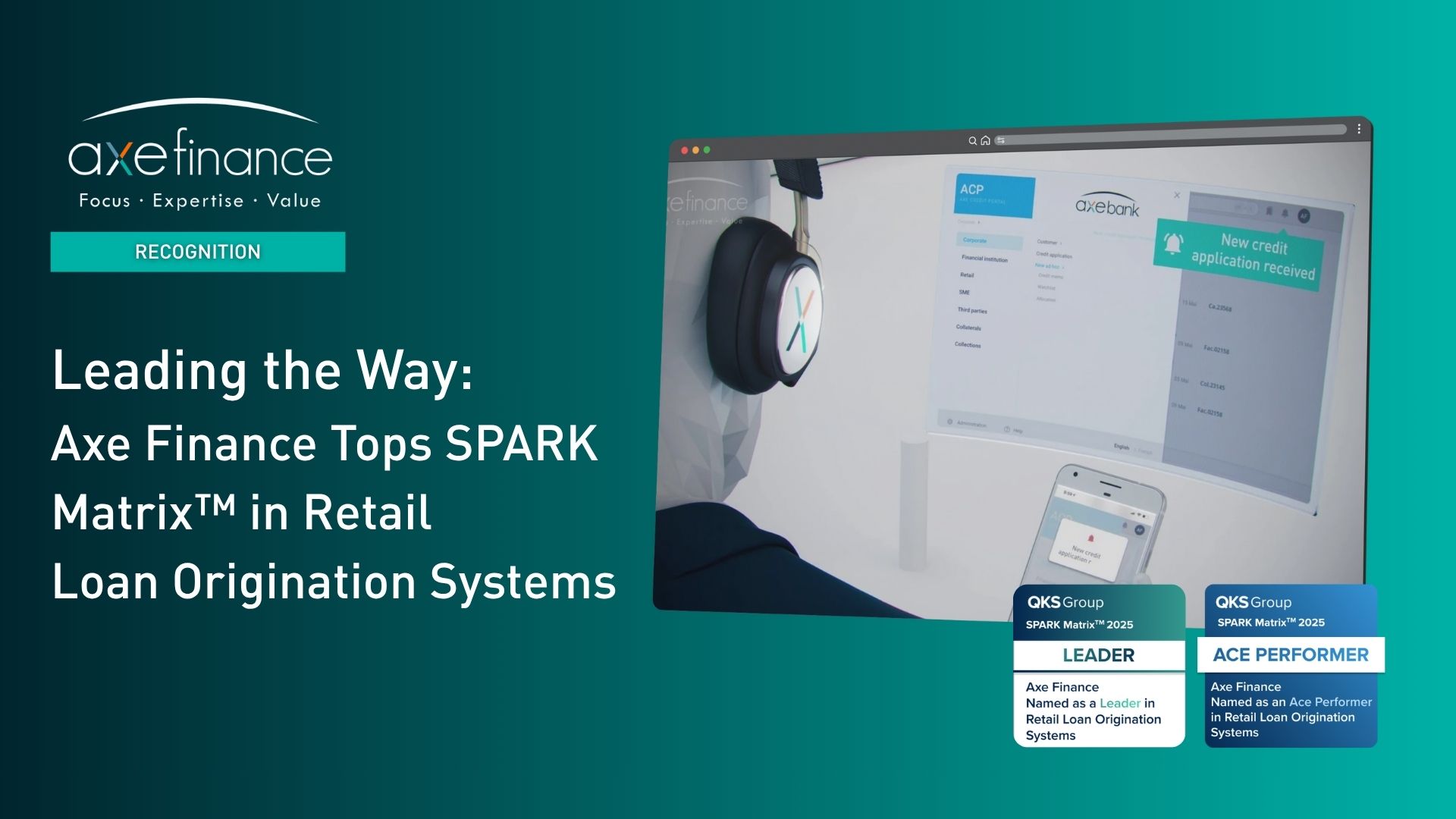

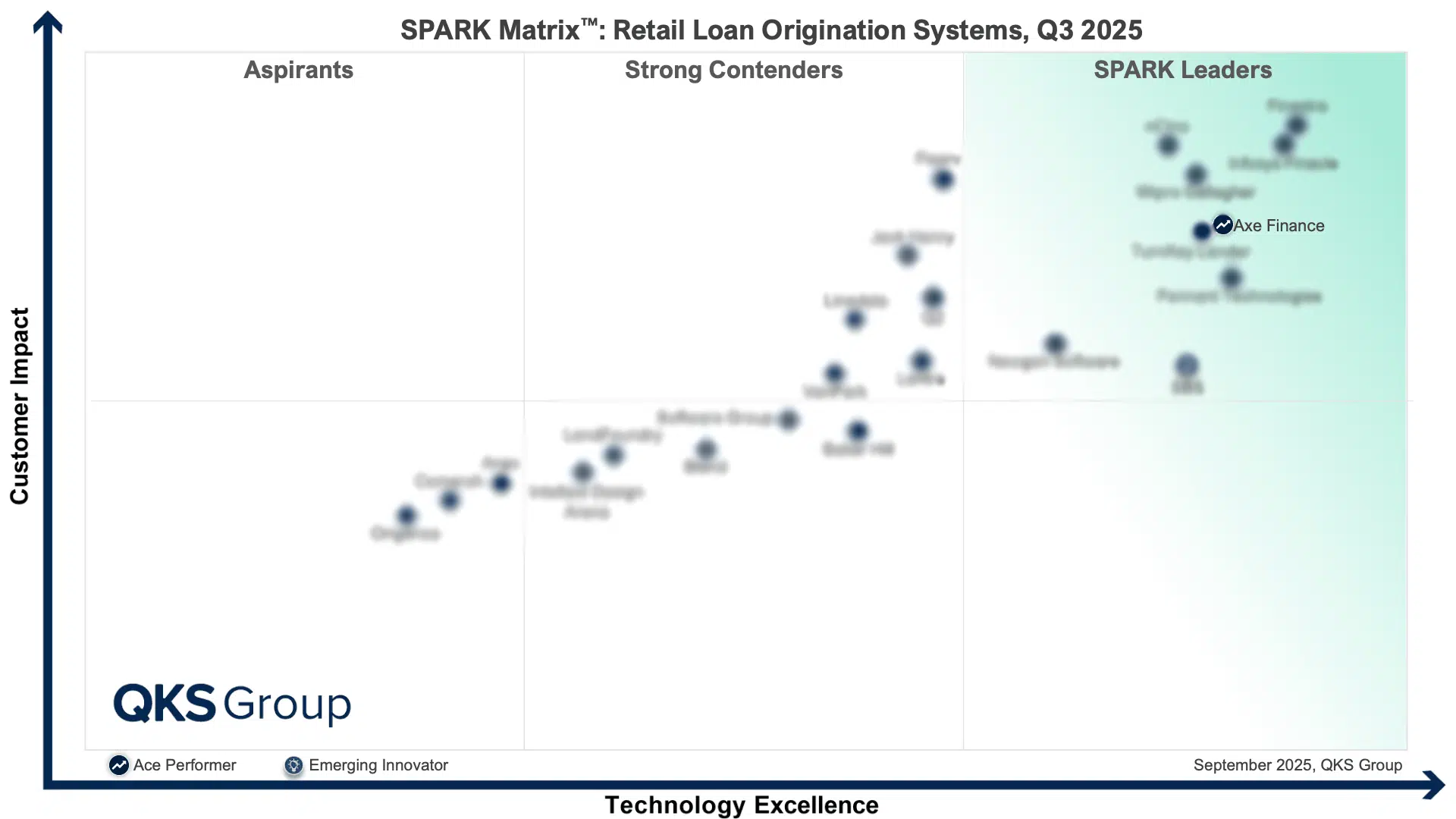

- The QKS Group SPARK Matrix™ provides competitive analysis & ranking of the leading Loan Origination vendors.

- Axe Finance, with its unified ACP platform, has received strong ratings across technology excellence and customer impact.

October 2025: QKS Group announced today that it has named Axe Finance as a Leader and Ace Performer* in the SPARK Matrix™: Retail Loan Origination Systems, Q3 2025.

Recognition

Akhilesh Vundavalli, Principal Analyst at QKS Group, states, “Axe Finance is redefining retail lending transformation through an automation-first approach that fuses advanced decisioning, intelligent workflows, and adaptive analytics into a unified origination ecosystem. Its AI-powered, zero-code digital lending platform orchestrates the entire retail credit lifecycle within a single, data-intelligent environment. Through its proprietary ACP Scoring Engine and ACP STUDIO toolkit, it empowers business users to reconfigure workflows, policies, and product parameters in real time without coding. By combining explainable AI with embedded compliance and omnichannel capabilities, Axe Finance is accelerating the industry’s move toward autonomous, compliant, and insight-driven retail loan origination.”

The QKS Group SPARK Matrix™ includes a detailed analysis of the global market dynamics, major trends, vendor landscape, and competitive positioning. The study also provides a competitive analysis and ranking of the IT Service Management Tools providers in the form of the SPARK Matrix™. The study also provides strategic information for users to evaluate different vendor capabilities, competitive differentiation, and market positions.

Akhilesh Vundavalli, Principal Analyst at QKS Group, states, “Axe Finance is redefining retail lending transformation through an automation-first approach that fuses advanced decisioning, intelligent workflows, and adaptive analytics into a unified origination ecosystem. Its AI-powered, zero-code digital lending platform orchestrates the entire retail credit lifecycle within a single, data-intelligent environment. Through its proprietary ACP Scoring Engine and ACP STUDIO toolkit, it empowers business users to reconfigure workflows, policies, and product parameters in real time without coding. By combining explainable AI with embedded compliance and omnichannel capabilities, Axe Finance is accelerating the industry’s move toward autonomous, compliant, and insight-driven retail loan origination.”

The QKS Group SPARK Matrix™ includes a detailed analysis of the global market dynamics, major trends, vendor landscape, and competitive positioning. The study also provides a competitive analysis and ranking of the IT Service Management Tools providers in the form of the SPARK Matrix™. The study also provides strategic information for users to evaluate different vendor capabilities, competitive differentiation, and market positions.

Quote by Axe Finance’s Chief Marketing Officer:

“We are proud to be recognised by QKS Group as a leader in the 2025 SPARK Matrix for Retail Loan Origination Systems. This recognition reflects our commitment to empowering banks with an AI-driven, zero-code platform that accelerates retail credit origination while ensuring compliance and customer-centricity. With ACP Retail Loans, we enable financial institutions to deliver faster, smarter, and more transparent lending experiences—helping them stay competitive in a rapidly evolving retail credit landscape.”

Commentary:

In 2025, retail loan origination is being reshaped by open banking, low-code agility, and embedded finance. Modern RLOS platforms deliver real-time borrower insights, AI-driven scoring, and omnichannel onboarding, while embedding compliance and ESG readiness. With features like gamified engagement, workflow automation, and advanced analytics, they reduce turnaround times and elevate borrower experience. As the SPARK Matrix highlights, leaders like Axe Finance stand out by unifying AI, zero-code configurability, and end-to-end risk visibility—helping banks scale retail lending quickly, compliantly, and competitively.

Additional Resources:

- For more information about Axe Finance, visit here

- SPARK Matrix™: Commercial Loan Origination Systems, Q3 2025

About Axe Finance:

Founded in 2004, Axe Finance is a global market-leading software provider focused on credit risk automation for lenders looking to provide an efficient, competitive, and seamless omnichannel journey.

Axe Finance developed the Axe Credit Portal (ACP) a future-proof AI-driven solution to automate the entire credit lifecycle from KYC to servicing, including origination, credit scoring, and automatic decision-making. ACP is a multi-segment digital lending solution covering not only Retail, Commercial, Corporate, FIs, and Sovereign segments but also other specific types of lending such as Microfinance, BNPL, embedded financing, and Islamic finance. Axe Finance is the trusted partner of reputable banks worldwide such as Société Générale, OTP, Al Rajhi Bank, ADCB, FAB, BBK, Bangkok Bank Limited, and Polaris Bank.

For more information about Axe Finance

Media Contacts:

Email: marketing@axefinance.com

About QKS Group

QKS Group is a global analyst and advisory firm helping enterprises, technology vendors, and investors make trusted, data-driven decisions. Our portfolio spans the flagship SPARK Matrix™ evaluation framework, SPARK Plus™ analyst advisory platform, QKS Intelligence™ for market and competitive tracking, and QKS Community™ for CXO leaders and practitioners. All offerings are powered by a Human-Intelligence-driven framework and QKS’s closed-loop research methodology – integrating expert-led insights, quantitative modeling, and continuous validation to deliver credible, outcome-focused intelligence.

For more available research, please visit Research

Media Contacts:

Shraddha Roy

PR & Media Relations

QKS Group

5th Floor, Wing 2, Cluster C,

EON Free Zone, Kharadi,

Pune, India

Email: shraddha.r@qksgroup.com