Lending In A Cashless Southeast Asia

Why Cashless Matters For Credit

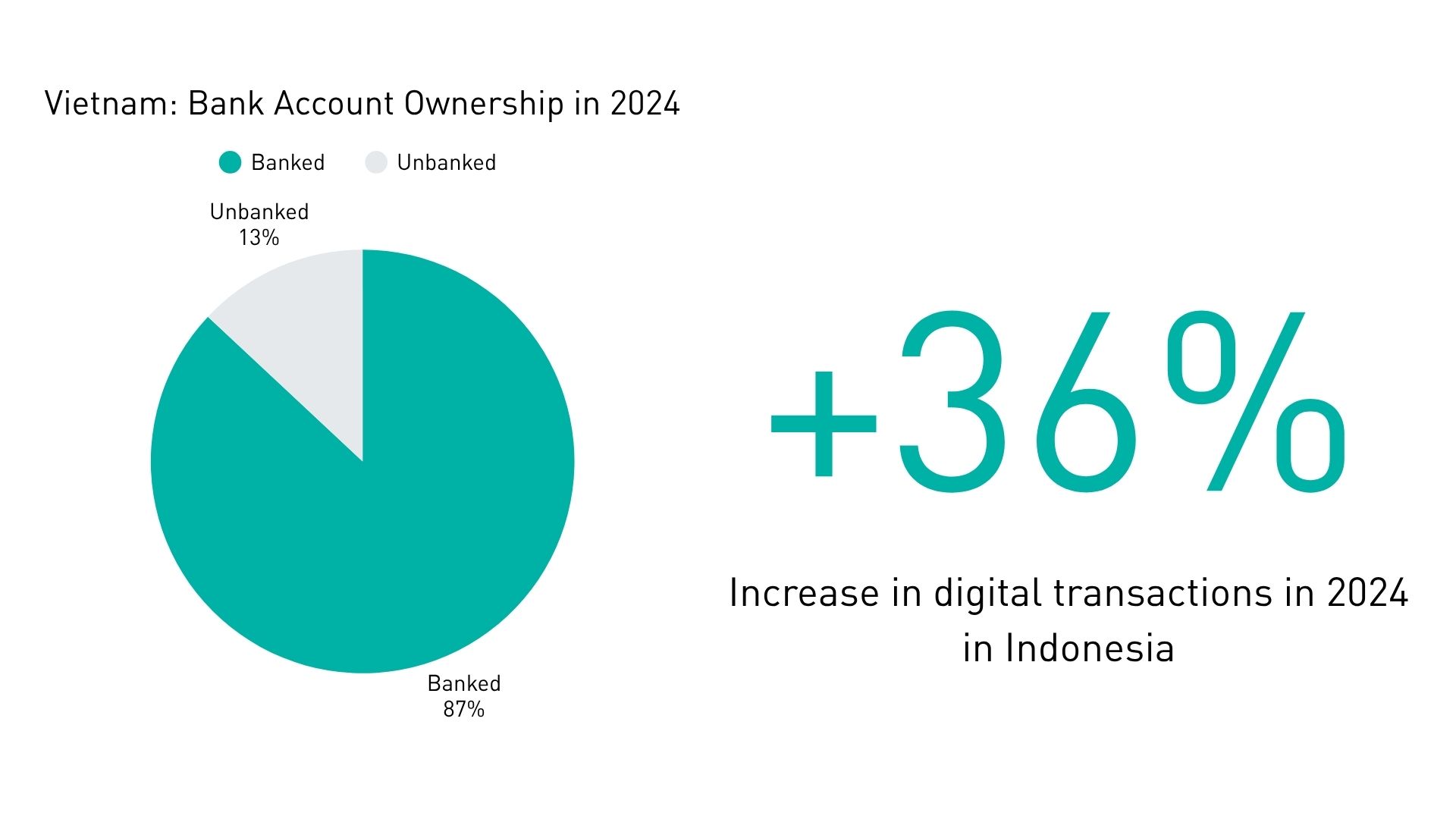

Modern rails—real-time transfers, interoperable QR, and mobile wallets—don’t just move money; they generate behavioural exhaust that improves underwriting and early-warning models. Thailand’s internet and mobile banking volumes remain among the region’s highest (see the Bank of Thailand’s live series), while Indonesia logged 34.5 billion digital transactions in 2024 (+36% year on year), signalling a deep, data-rich shift in everyday spend and receipts. In Vietnam, account ownership is now near universal, with 86.97% of adults holding bank accounts by end-2024. The World Bank’s newly released Global Findex 2025 confirms rising digital usage across developing economies—fuel for more granular, real-time affordability checks.

- Thailand: the Bank of Thailand publishes monthly series for internet/mobile banking transactions and values (billions of baht), useful for building demand seasonality into decisioning; see the official table here.

- Indonesia: Bank Indonesia highlighted strong digital growth with 34.5 billion transactions in 2024; universities and industry bodies also document the expansion of QRIS acceptance.

- Regional NPL context: Asia’s average NPL ratio was about 2.7% in 2024, a useful regional benchmark when calibrating risk appetite and buffers.

Credit Risk Management

Portfolio Health In Focus

- Thailand: household debt remains one of Asia’s highest—~88.4% of GDP at end-Q4 2024, with Bank of Thailand (BoT)’s Financial Stability Report echoing the same level. This elevates sensitivity to rate changes and income shocks, pushing lenders to tighten affordability tests and post-disbursement monitoring.

- Indonesia: credit quality is stable; OJK cited gross NPLs around 2.22% in Mar 2025, after ~2.18% in Jan–Feb, alongside robust loan growth late-2024.

- Philippines: banks’ NPL ratio printed ~3.4% in Jul 2025, up versus June but broadly manageable; forecasters see a mild uptick as unsecured portfolios season.

- Regional lens: the ADB’s NPL Watch 2025 pegs 2024’s Asia average near 2.7%; dispersion is wide, so calibrate by segment and country.

Underwriting In A Cashless Economy: What To Actually Change

- Expand data coverage: blend bureau, bank-account, IPS, wallet, payroll, and merchant-acquirer feeds—consented and explainable. The MSME finance gap remains $5.7 trillion (IFC), and thin-file scoring requires alternative signals rather than higher marketing spend.

- Real-time affordability: spend and transfers are 24/7; checks should be too. Use rolling income volatility, seasonality, and post-disbursement cash-flow triggers (e.g., IPS inflow drops ≥30% week-over-week) to control utilisation and prompt proactive outreach.

- Channel-aware limits: wallets may be funded by cards or accounts. Visa notes card credentials remain critical to wallet usage in SEA—model limit tiers by funding mix to avoid overstating liquidity; see Visa’s analysis of cards-wallet interplay.

- Consumer credit vigilance: watch instalment stacking across BNPL, cards, and wallet credit. Research houses project double-digit BNPL growth in APAC in 2025; plan early-warning scorecards that react to rising minimum-payment ratios, short-term refinancing, and missed e-commerce pay-ins.

- Collections that learn: deploy ML-guided promise-to-pay strategies; nudge to low-friction channels first and escalate on risk signals, not blanket policy.

Fraud And Operational Risk On Instant Rails

Faster rails compress the window to detect scams and mule activity. In Aug 2025, Thailand mandated daily caps for many online transfers—50,000 baht for vulnerable users with higher tiers post-verification—part of a wider crackdown on scam rings. Lenders should assume T+0 velocity and design controls accordingly.

- Apply device risk, behavioural biometrics, and beneficiary-risk scores at origination and disbursement, not just login.

- Step-up verification for first-use beneficiaries, cross-border pay-outs, or transfers to PSPs with elevated dispute rates.

- Where regulation permits, share and consume consortium signals on mule accounts and scam typologies; align with national initiatives and BoT guidance.

Lending Transformation

From Payments Exhaust To Credit Insight

- Thin-file scoring: alternative-data adoption keeps rising among lenders (e.g., payments behaviour, platform turnover). Pair with bureau and bank data for explainability.

- SME working capital: acquirer and marketplace turnover can proxy cash-flow for unsecured limits; recalibrate limits daily or weekly based on sales volatility and dispute rates.

- Embedded credit: lending at the point of activity (B2B marketplaces, gig platforms) with guardrails for concentration, tenor mix, and sponsor quality.

Governance And Stress Testing

- Run cash-light scenarios (e.g., 20–30% shift from cash to IPS/wallet) and re-estimate PD/LGD on new data densities.

- Overlay macro: where household leverage is elevated (Thailand ~88.4% of GDP end-2024), apply tighter affordability buffers and slower credit-line growth.

- Back-test IPS-era fraud shocks (T+0 velocity) against authorisation, disbursement, and repayment controls; rehearse scam-response playbooks tied to regulator thresholds.

Cross-Border Instant Payments And Project Nexus

Why Lenders Should Care

Project Nexus—a BIS (Bank for International Settlements) Innovation Hub initiative with first-mover central bank partners in India, Malaysia, the Philippines, Singapore, and Thailand—completed a comprehensive blueprint in July 2024 and moved to implementation governance by incorporating Nexus Global Payments (NGP) in Singapore in April 2025. For lenders, this means faster cross-border collections/repayments, richer behavioural data, and new fraud vectors—all of which belong in credit policy and limits playbooks.

What To Add To Your Credit Playbook

- Cross-border affordability: build income proxies from remittance inflows and export invoices; expect shorter lags in verifying cash-flows.

- FX and settlement risk: for MSMEs borrowing locally against cross-border receivables, stress test FX shocks on PD and LGD across tenors.

- Fraud vectors: treat first-time cross-border beneficiaries as higher risk; use consortium and IPS-network signals as they mature under NGP governance.

How Axe Finance Enables Lending In A Cashless Era

Decisioning And Orchestration

- Credit Scoring & Decisioning: configure bureau + alternative-data strategies; build challenger scorecards; deploy policy rules for IPS/wallet-heavy applicants.

- Retail Lending and AI-Based Lending: instant pre-approvals, cash-flow underwriting, and BNPL/work-now-pay-later flows with risk-based pricing.

- Omnichannel origination (ACP Omnichannel): consistent KYC/KYB, device-risk checks, and consent management across branch, app, and embedded partners.

Portfolio Risk Control

- Early-warning systems using IPS/wallet signal drops, merchant-acquirer sales declines, and dispute spikes.

- Collections optimisation with event-driven workflows and hardship/forbearance logic tuned to regulator guidance (BoT, OJK, BSP).

- Stress testing and limit governance mapped to local NPL dynamics (ADB regional benchmarks, country specifics above).

Quick Checklist For Risk Leaders

- Data: secure IPS, wallet, and acquirer feeds; define consented feature sets for affordability and PD; ensure explainability.

- Policy: align credit caps and debt-to-income rules to real-time spend patterns; add BNPL stacking controls; incorporate channel-funding mix into limits.

- Fraud: implement step-up and mule checks at disbursement; wire in consortium alerts where permissible; respect national transfer-cap regimes.

- Ops: move to same-day limit refreshes and collections outreach; design for “instant everything” (T+0 authorisation, disbursement, and repayment eventing).

- Compliance: keep regulator-specific triggers (e.g., transfer caps, scam safeguards, KYC tiers) inside your decisioning flow; evidence policy effectiveness with audit trails.

FAQs: Lending In A Cashless Era

Do We Need To Integrate QR Or Wallet Data Directly Into Our Scorecards?

Not necessarily on day one. Start with account-to-account IPS data and acquirer sales for SMEs. Add wallet and QR telemetry once you have consent flows and model governance for alternative data. The goal is better signal-to-noise, not hoarding data that isn’t explainable at adjudication.

How Should We Treat BNPL In Affordability And Limit Setting?

Model BNPL-style obligations explicitly as revolving or instalment exposure and watch for stacking across multiple providers. Given APAC’s double-digit BNPL growth forecasts for 2025, expect more overlap with card and wallet credit; design early-warning rules for rising minimum-payment ratios and short-term refinancing.

Will Cross-Border Instant Payments Change Collections?

Yes—faster repayment confirmation and richer behavioural data will help you right-size repayment plans and trigger hardship options earlier. Project Nexus governance (NGP) should improve standardisation of data and compliance signals as participating IPS link up.

Conclusion

The cashless shift in SEA is ultimately a credit story: more data to price risk, faster rails to fund and collect, and tighter controls to keep fraud and delinquency in check. The headline tension won’t disappear—inclusion vs over-indebtedness, speed vs exposure—but lenders that re-platform underwriting and portfolio management for an instant, data-rich world will grow safely while widening access. Pair disciplined governance with pragmatic experimentation (challenger scorecards, channel-aware limits, real-time affordability), and you’ll navigate the cash-light decade with fewer surprises and better unit economics.