We are pleased to announce the launch of instant automated credit card loans at a top-tier Vietnamese bank

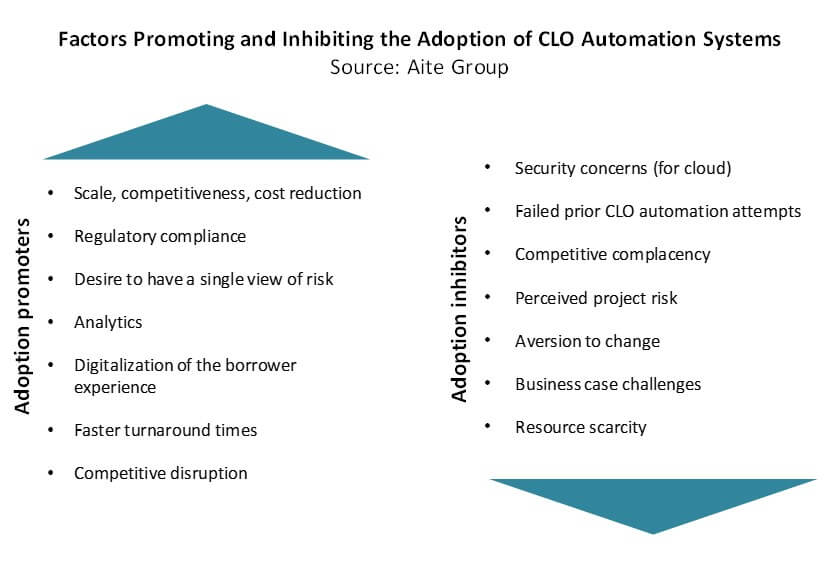

An award-winning bank in the region set out to find the right partner to help automate its credit card lending. The bank launched a rigorous 9-month selection process aiming at replacing its legacy system with a more powerful solution that would boost loan performance and help the bank stay ahead of the competition. This process led to an axefinance solution reward for the bank’s lending digitalization across five business units: Credit Cards, Retail, MSME, SME, and Wholesale Banking.

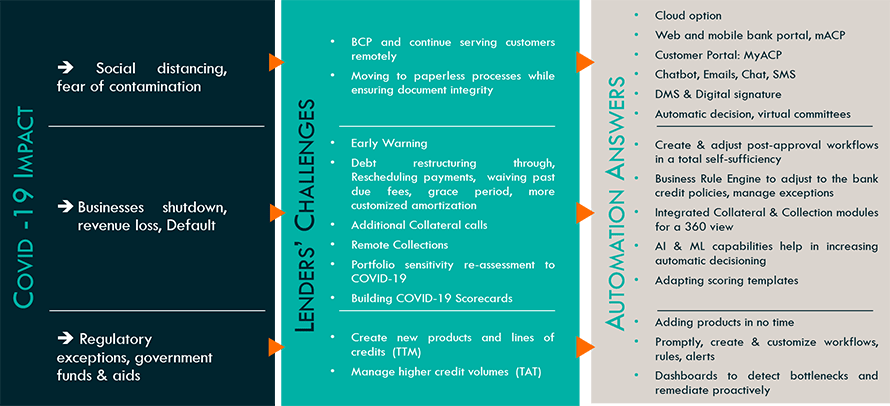

The project’s first phase has been progressively rolled out and is already live, covering secured & unsecured credit card loans. Even though there was a significant evolution of the bank’s risk policies after the initial scoping, thanks to axefinance expertise and close collaboration, project deadlines were met and there was no impact on the budget. The teams also overcame the significant COVID pandemic challenges, with many critical implementation phases performed entirely remotely.

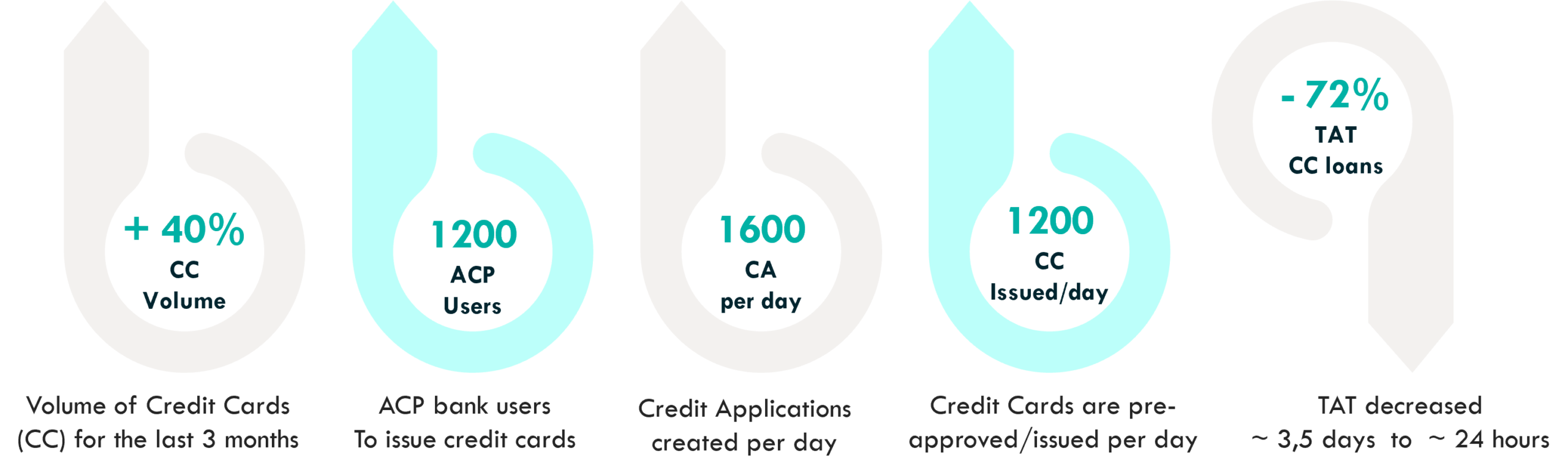

Despite the very recent user adoption of ACP, spectacular performance improvements have been realized:

ACP contributed to increasing credit card loans process efficiency through:

- An end-to-end automated credit card process

- One single system entry point for all credit stakeholders thanks to seamless integration and smooth communication between 15 third-party systems.

- An automated delegation of authority driven by a combination of business requirements and user authorities.

- Automatic decisioning based on predefined business rules & scoring.

- An automated workload assignment based on predefined criteria such as the credit amount, the number of credit applications, the threshold, etc.

The project also ensured a seamless omnichannel customer journey where credit applications can be initiated from multiple channels. Thanks to ACP, the bank successfully onboarded customers from multiple channels such as the bank’s mobile app, internet banking, website, third-party systems, and offline channels (RM sales tool, branch counter…)

The head of The Technology Delivery Service Department at the bank said:

Overall, we are very happy with ACP, it allowed crystal clear efficiency and credit risk mitigation gains. The most appreciated component of this solution is for me the Business Rule Engine, a real game-changer in terms of configuration UX and flexibility.

Thanks to fully digitalized credit card loans processing through ACP, the bank maintained its growth even during the lockdown period and, the turnover of the credit cards business segment has been significantly increased.

Istabrak Kamoun, the project director at axefinance confirms:

Lending Digitalization is a primary driver of competitiveness for financial institutions, we are proud to help this bank strengthen its leading position in the region. The axefinance implementation team has demonstrated a high level of commitment, efficiency, and quality while achieving a smooth Go-Live despite the complexity of the implemented project scope as well as the constraints imposed by the COVID-19 context and time zone difference.

About axefinance

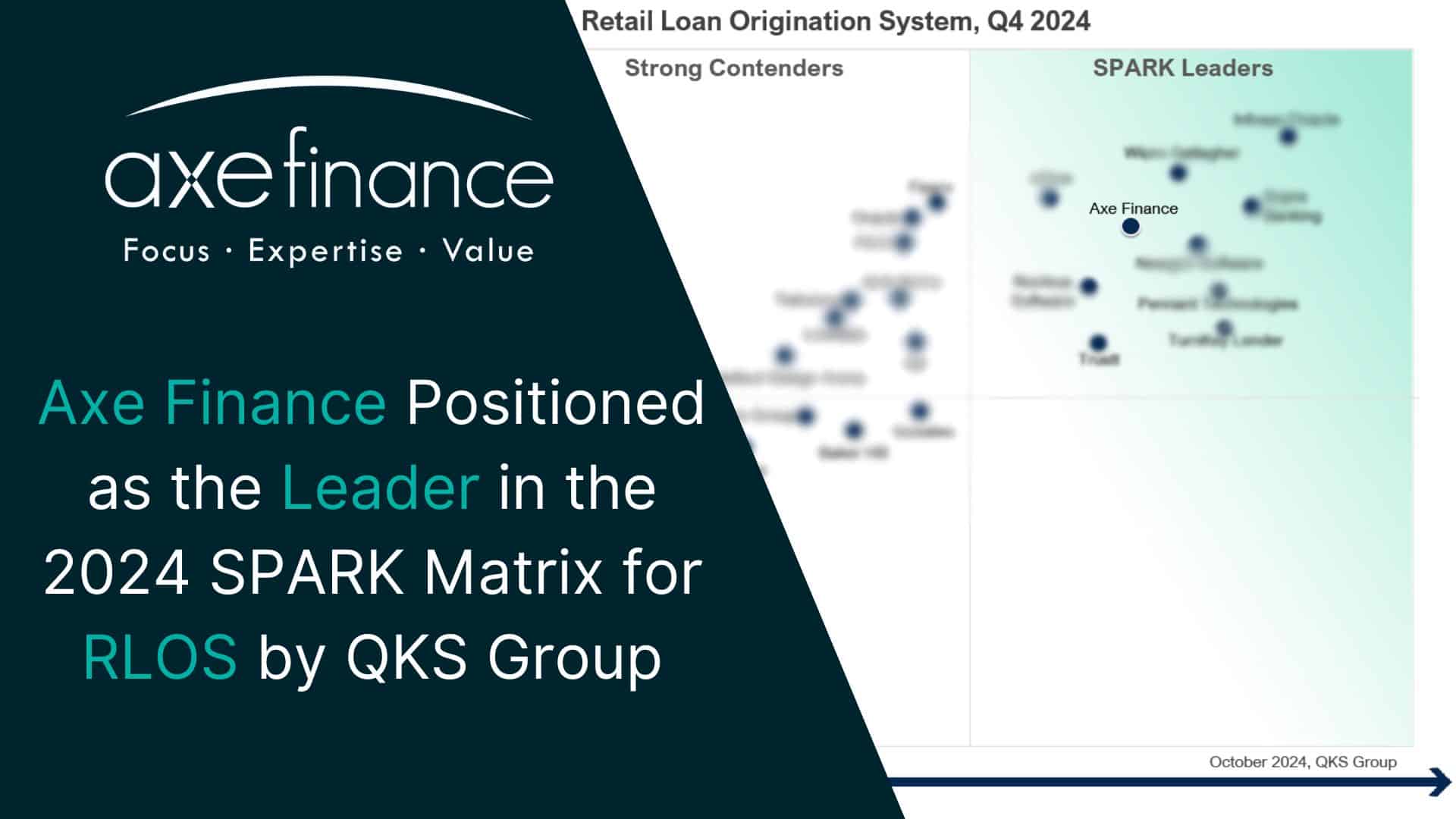

Founded in 2004, an international software provider focused on lending automation for financial institutions looking for an edge in productivity and customer service for each and every client segment (Retail, Commercial, SME, Corporate…)

Axe Credit Portal is axefinance’s end-to-end AI-based solution for credit automation available either as a locally hosted or as a cloud-based solution. ACP users experience improved profitability, higher productivity, and increased customer satisfaction while keeping up with ever-changing compliance regulations and internal policies. axefinance counts major players among its global customers’ database; Société Générale, OTP, ARB, ADCB, FAB, BBL.