Reap huge benefits from an SaaS lending platform

axe Cloud Lending

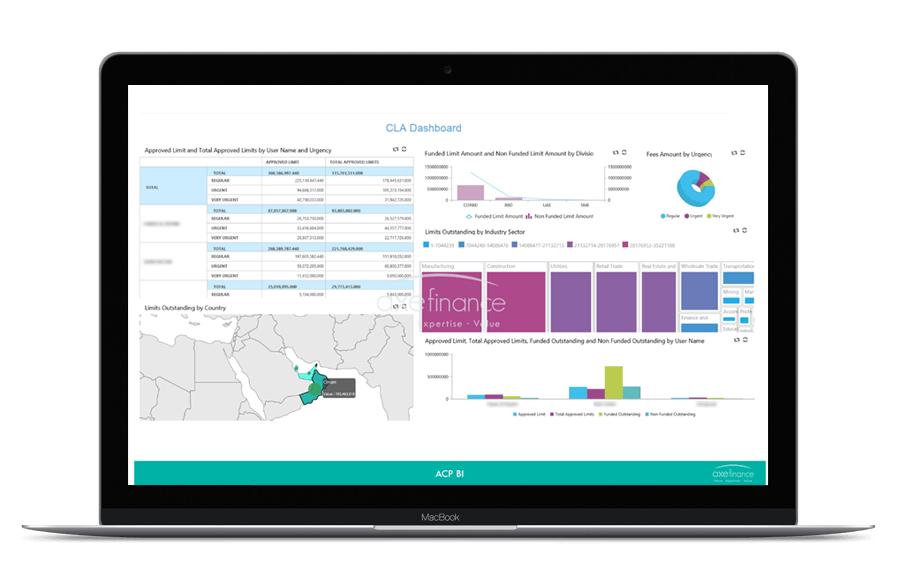

ACP helps lending institutions increase customer satisfaction, reduce costs through operational efficiency and proactively mitigate risk and assure compliance with regulations.

ACP can be implemented as a software or through the cloud. Opting for axe Cloud Lending makes you benefit from a state-of-the-art credit automation solution with the convenience and cost advantages of cloud-based loan origination system.

Industries served by our Cloud lending platform: Banks, Microfinance, Lease Finance, SME Lenders, Community Banks, Consumer Lenders.

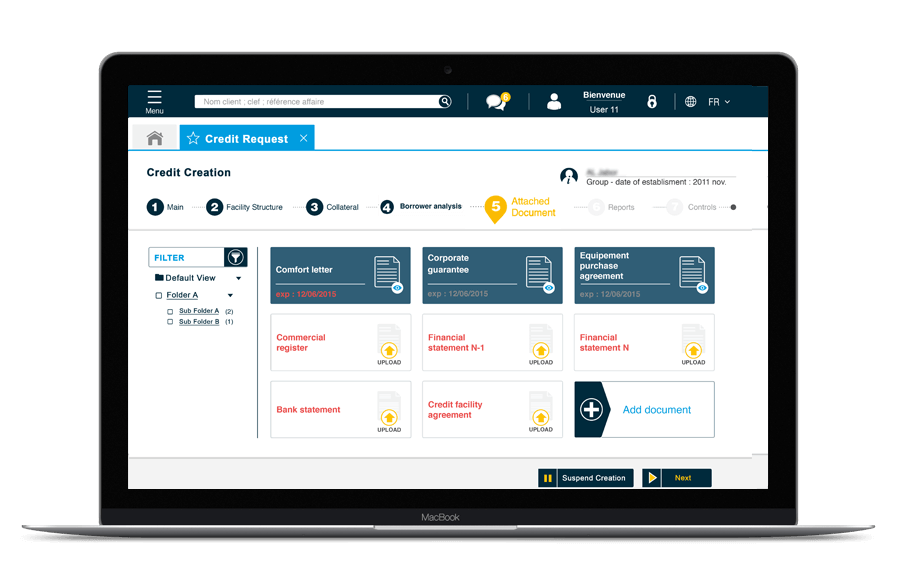

Easily digitize the lending process

- Fully cloud-based solution

- Quick Deployment across branches

- Seamless integration with third-parties’ systems with a set of API’s

- Access from anywhere

- Streamline all lending activities on a single cloud-based system

- Customize solution with no need for vendor intervention

- Automatic Backup and Disaster Recovery

- High scalability

- Safe and secure (Transparent Data encryption)

Benefit from a Competitve &

low total cost of ownership

- Subscription based fees (No Capex required)

- Faster & easier Implementation

- Automatic upgrades

- Reallocate resources on added value projects

- Higher volumes of credit with improved turn-around-times,efficiencies and lowered risks

- Highly connected and collaborative environment for allstakeholders

- Faster time-to-market for new products and offers

Check out our documents

Resources